Flation isn’t a real word. I made it up. It’s kind of like when people call themselves an entrepreneur that operate as part of a pyramid scheme…. “business owner”. It’s made up.

Following the economic cycle waves, there are times when economies are growing and expanding, money is being spent, and investment is being made. However, there are also times of distress and troughs in the cycle, where economies are stagnant or not growing, money is not being spent, unemployment is increasing, and investments are being pulled. Typically, the “flavors of flation” follow the economic cycle peaks and troughs. We will spend some time discussing what these flavors are as it relates to goods and services and the overall economy, and what factors drive each state of flation, as well as what is required to return to a healthy equilibrium. We will also touch upon how this relates to the current economic climate reality that we find ourselves in due to the shutdown of global economies in 2020.

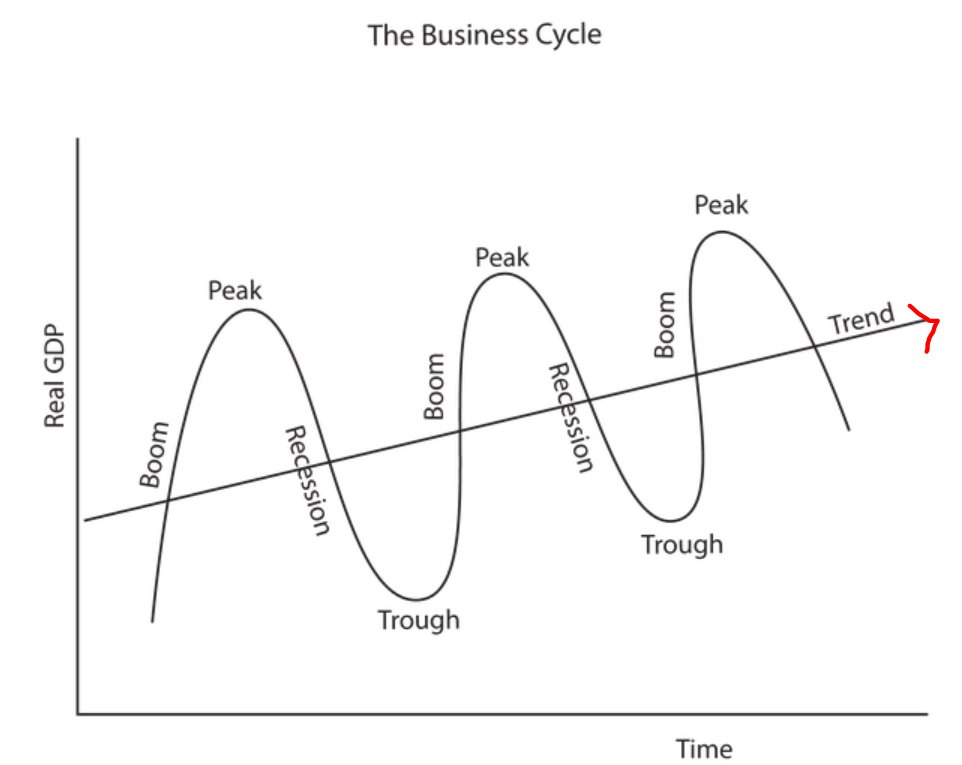

Figure 1 shows a theoretical business cycle, or economic cycle, with peaks and troughs over time. The x-axis represents time, and the y axis represents economic output, or GDP. As discussed in Lesson 40, Gross Domestic Product (GDP) is a measure of a country’s economic health. It measures the value of all goods and services produced over a period of time by considering personal consumption, net exports, private and public investment, and government spending.

As you can see, over the long term, the wave has an upward trend as economies continue to grow over time (higher highs, and higher lows over the long term).

Inflation

Inflation occurs when the average price of a good or basket of goods increases over time. In most economies, there is always some level of inflation that exists. This is easily apparent when we look at how purchasing power decreases over time. For example, a dollar today is not worth a dollar tomorrow. The same house would cost a lot more in 2020 than it did in 1950. This is because of inflation. The rate of inflation can top at the peak of the business cycle. Some “optimum level” of inflation is ideal to encourage investment and spending instead of saving money to drive economic growth. Money supply growth outpaces economic growth in an inflationary environment. While an optimum level of inflation is ideal, over inflation needs to be avoided for any good or service as this will drive up prices dramatically, making it unaffordable to most consumers.

Contributing factors to inflation:

Increased demand for a good or service, which outpaces supply

Increase in money supply and credit. Consumers will have more ease to borrow and access funds to buy things, which in turn drives up demand for goods and services.

Increase in production costs of a good or service, or its supply chain, thus resulting in a higher price to maintain margins

Interest rates being “too low” or lower than an optimum level determined by central banks or monetary policy makers

Inflation can lead to higher costs along a good’s supply chain, which makes it more expensive to export these goods to foreign markets. This would widen a domestic country’s trade deficit and depreciate the domestic currency.

Strength of local currency decreases against other international currencies. This forces individuals to lessen their holdings of their domestic currency and to buy other stable foreign currencies.

For prices to “deflate” from an inflationary state, the following must occur:

At a macroeconomic level, increasing interest rates through monetary policy to discourage borrowing and spending

Increased supply or decreased demand of a good or service, which in turn will help drive down prices of a good or service based on supply-demand economics

Spending must be capped or slowed down. Access to credit and cheap debt must be limited, hence the need for increased interest rates.

Deflation

Deflation, or negative inflation, occurs when the average price of a good or basket of goods decreases over time. This can be seen during a time when prices of a particular good fall and stay at these lower levels for a prolonged period of time. Purchasing power actually increases in the short term, where one can purchase more with a unit of currency now than they were able to yesterday. Deflation usually peaks at the bottom of a business cycle. It is rare for deflation to exist for a prolonged period of time at a macroeconomic level as economies are usually “growing” at some level. However, it isn’t uncommon for certain commodities or industries to experience deflation at times, which could be a catalyst for an overall economic slowdown.

Contributing factors:

Over supply and lower demand for a good, which drives prices lower. Increased productivity through innovation can lead to an abundance of goods and services as supply chains become more efficient.

A drop in demand will occur when consumers are not buying goods or as much goods as before. If consumers aren’t spending, it might be because they don’t have money, and if they don’t have money, it’s because they don’t have a job. Increased unemployment could be a factor for deflation.

Decrease in credit and money supply. Consumers will have less access for funds to purchase goods, which in turn will drive down demand as supply levels remain elevated.

Local currency actually strengthens substantially against all other foreign currencies because money supply is limited. This will continue as individuals in foreign countries exchange their cash holdings to own this local currency instead. This is essentially an increase in “purchasing power” of the local currency.

In an over leveraged economy (high loan to asset ratio), deflation can result in a temporary financial crisis and force consumers and businesses to liquidate investments and other assets to stay afloat and liquid.

For prices to “inflate” from a deflationary state, the following must occur:

Levels of spending must increase, both at a consumer level and at a government level

At a macroeconomic level, some form of economic stimulus is required through fiscal policy around government spending or decreased taxation

At a macroeconomic level, some form of economic stimulus is required through monetary policy, typically through quantitative easing (central banks purchasing treasury bonds, resulting in money being injected into the economy), or decreased interest rates

Increased investment in the local economy by financial institutions and retail investors.

Now for the “flavor of flation” that isn’t talked about as much, like an ugly duckling of the bunch…

Stagflation

Stagflation, or zero inflation, occurs when the average price of a good or basket of goods stays neutral over time. This coincides with flat wage growth and no change in purchasing power over this period of time. This is the middle ground in between deflation and inflation. Similar to deflation, it is rare for goods and services, and overall economies, to experience stagflation for prolonged periods of time.

Contributing factors:

No growth in industry

This could happen after a drop in demand levels which puts pressure on the price of goods and services, almost counterbalancing any existing inflation

Similar to deflation, a drop in consumer demand for goods and services due to increased levels of unemployment can be a factor. Of course, stagflation must theoretically be met first before entering deflationary territory.

Similar to deflation, a prolonged state of stagflation is not good, and a state of inflation is desired. For prices to “inflate” from a stagflation state, the same things must occur similar to lifting out of deflation. Increased spending and injection of money into the economy is required, either through monetary or fiscal policy.

It is possible that an environment of deflation is reached first after stagflation, and before inflation begins to enter the picture again. This could be the case in an economic recession (or depression as worst-case scenario), where demand for goods and service falls dramatically, and time is needed for prices to fall to an equilibrium point where consumers will start buying goods again, and ultimately reduce the supply of these goods.

So how do these “flavors of flation” relate to the current economic conditions in Q2 of 2020?

Given the global shutdown of economies due to the COVID-19 pandemic, there is substantial decline in demand for many goods and services, which has in turn created an over supply of these same goods and services. Demand for energy commodities has declined as aircrafts sit idled, as people are staying home and aren’t driving their vehicles, and as people are remaining at home to work. Electricity demand and natural gas usage at home is likely increasing, but collectively this is still small compared to the lost demand in energy usage of many office towers and retail shops that are now closed. Demand for consumer discretionary is still the same (probably increased at first due to the hoarding mentality of irrational doomsday fanatics), but demand for luxury consumer goods has fallen off a cliff. As many individuals have been laid off as a result of businesses being shut down, households are focused on paying their monthly mortgage and bills right now, not on teeth whitening, cosmetic surgery, and luxury brand clothing. No one is booking hotels, vacations, or flights right now either. Unemployment continues to rise, which puts pressure on average consumer spending. Less spending results in less demand on average for overall goods and services, and creates over supply of these same goods and services. Central banks have already reduced interest rates to near zero, and there has been substantial quantitative easing programs set in place already to help fuel economic activity. So on one hand, we have drivers for price decline of goods and services due to decreased demand and oversupply, but on the other hand, we have large injections of money into the economy and greater ability to access credit via lowered interest rates.

It seems like both ends of the supply-demand rope are being pulled, and only time will tell which side prevails. Lowered interest rates do make borrowing easier, but people who are unemployed and have no income can’t afford to pay back the loans anyway, never mind the interest on these loans. There have been ample efforts to reduce oil supply coming onto the market amongst the world’s biggest oil producers, but trying to fix the supply problem doesn’t help the fact that there is such little demand for oil and other energy sources right now anyway given the global economic shut down.

If anything is for certain, a restart of global economies will be a lengthy process, and not one that will be as easy as flicking on a light switch. It’s likely that many economies are already in a recession, but only time will tell whether prolonged shutdown of economies, increased credit delinquencies, and amplified unemployment will be a catalyst for a depression, and whether a stagflationary/deflationary environment for overall goods and services will coexist.