We all seek out balances in our lives in many forms. This could be balancing time at the office to time at home, balancing diet and exercise choices throughout the week, or balancing which priorities are important in your life and deserving of your attention.

Balancing one’s finances is another one of these forms, and this can be done in a number of ways. A quick budgeting exercise can help one balance saving versus spending. Another form of assessing your current financial situation can take the form of tracking your personal “balance sheet”. You own assets, you have debt and owe money, and the net of those two things is your personal net worth. This is your personal balance sheet, and everyone has one. Tracking net worth shouldn’t be a relative comparison tool against others to make yourself feel superior, but rather a tool to keep you in check with your personal finances, and be cognizant of when and where your money is going, how much is coming in, and how much you are retaining through savings and investments. This lesson will look at creating a “net worth” template, and why it’s important to have one and keep track of it over time. Let’s get started!

First let’s start by listing all of the assets that you own. Assets can consist of:

Cash

Investments

Real Estate

Vehicle

Collectibles

Anything else that holds long term value

Once the list is completed, balances or values must be assigned to each category. For non cash assets like real estate and vehicles, assign what the current market value is of these assets. This may vary from what you purchased these assets for. Obviously with vehicles, as highlighted in Lesson 11, depreciation is a beast and will erode the value over time very quickly. With real estate, property value will change mainly due to the change in value of the land. Technically, the structure itself that sits on land doesn’t appreciate, but actually depreciates. It’s the land that actually increases in value over time that drives up real estate prices.

Secondly, we will look at liabilities. Create a list of liabilities, or things that you owe money towards. These can include

Credit card balances

Car loans

Mortgage

Student loans

Other debt

These are balances that you owe to someone else (namely the bank typically) and must be subtracted from the asset value balance to get a true sense of what you actually own.

With that said, to calculate your overall net worth, simply subtract the liabilities from your asset value. To be more accurate, line up relevant liabilities with the underlying asset to get a true sense of the portion of the value that you own. For example, subtracting credit card debt from your cash balance will give you a better sense of how much cash you have on hand once you’ve paid off your short-term debt obligations. Subtracting your mortgage balance from your home’s market value will give you the equity that you actually have in your house, or in other words, the amount of “house” that you actually own.

Figure 1: Net Worth Infograph

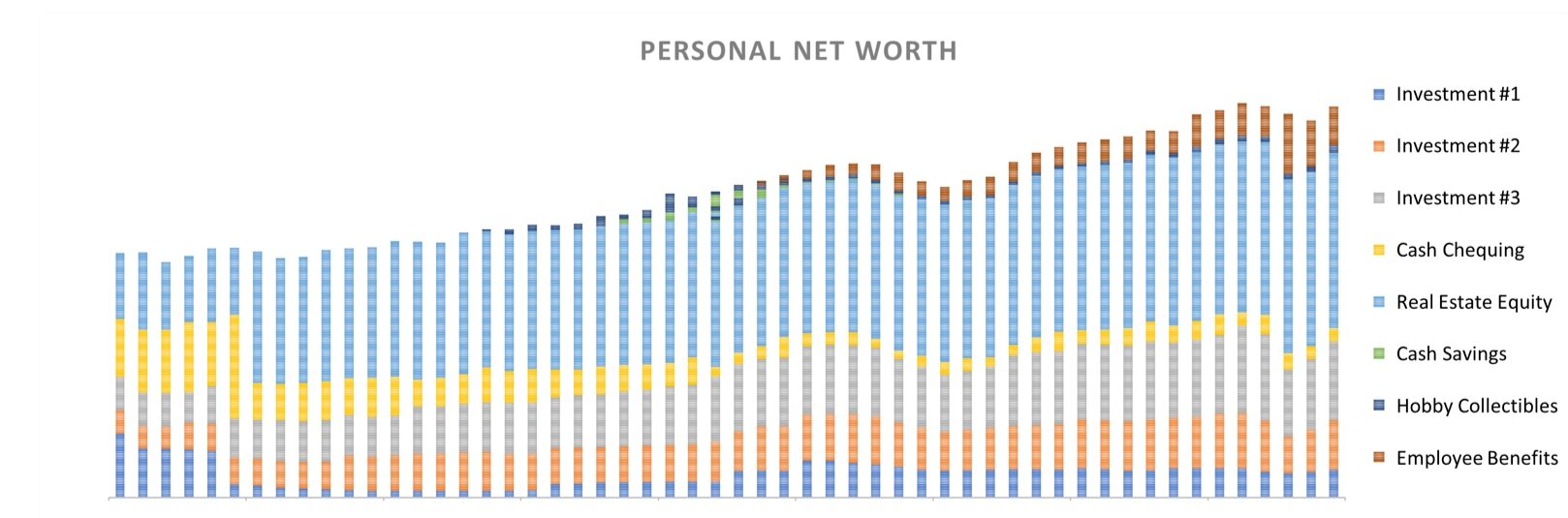

A net worth update can be done periodically, say every month or every quarter, to allow yourself to analyse your asset and liability balances over time. The holistic view can provide transparency into how one’s net worth is trending over time. Given inflation, the steady rise in asset prices and investments over time, and the reduction in mortgage balance over the amortization term, the net worth trend should be increasing over time. If it remains flat, or even is decreasing over a sustained period of time, say more than a year, then a review of one’s expenses and debt obligations may be order to determine which expense categories can be reduced and addressed.

Figure 2: Net Worth Historical Tracker Sample

Here are two good metrics to keep track of in addition to your net worth:

Debt to Equity ratio: this ratio looks at the portion of debt to your overall net worth. This provides valuable insight into how leveraged you are in relation to what you actually own, and how well your debt is covered. Ideally this ratio should trend down over time as mortgage debt decreases over time. For more disciplined and sophisticated investors, maintaining a manageable debt to equity ratio can provide consistent compounding returns on investments, but only if managed appropriately! Getting carried away with leverage can be very dangerous, especially if regular payments and cost of capital exceeds your liquid assets amount.

Non real estate asset value to real estate value ratio: This gives an indication of how much your total assets depends on the value of your home, or total real estate. Having all of your net worth tied up in your primary residence, or in real estate in general, greatly reduces one’s liquidity, or ability to transition assets to cash. It’s nice to own property and assets, but you don’t want to be cash poor. You never know when sudden expenses in life may arise, and when they do, you want to be sure to have the money readily available to cover these. A ratio of 1 indicates that your non real estate assets equals the market value of your real estate. Rule of thumb is that aiming for a ratio of 1 or higher is a good indication of financial independence, as well as a diversified list of assets owned that doesn’t heavily rely on the fluctuation of your home’s value.

The purpose of tracking your personal balance sheet is to keep you disciplined with your short-term spending and saving, as well as with your long-term investment and retirement goals. Everyone’s financial situation is different, so the only relative comparison you should be doing with this kind of information is with yourself over time. To maintain discipline, you can set short-term and long-term personal balance sheet goals, so there is a purpose or something to trend towards over time. Don’t forget to reward yourself when you do reach a milestone… that way, there’s something to look forward to along this journey after all!