Ah yes, the month of November means the month of financial literacy. It’s a month to be bombarded by annoying Christmas advertisements, a month to realise you have failed to fulfill your News Years Resolution goal for the year, and hopefully a month to reflect on your personal financial well being.

In the absence of lesson posts for November, I figured it is only fitting to briefly spend some time reflecting on Financial Literacy month. Truthfully, it’s been quite the busy last few weeks, and part of that busy-ness was due to the work I was doing as part of the Global Shapers of Edmonton hub. With the help of many hub members, this work involved the production of a series of “Fireside Chat” videos where various personal finance topics were discussed in light of Financial Literacy month. I think it’s fitting to briefly go over these videos and provide links to the videos for your viewing pleasure (no pressure to watch them, but having less than 50 views on a YouTube video isn’t going to make me any advertising revenue any time soon, never mind a YouTube star…). If you can get over my awkward demeanor, I do think there is a lot of value to gain from watching these discussions!

Fireside Chat #1: What scares you about personal finance?

This is a loaded question and will have different answers amongst a group of people. Debt, credit card statements, inflation, or even the general economy can all set a sense of unease amongst people. Finance, or even money in general, is almost a taboo topic to discuss openly with other people. Perhaps it’s because you feel as though it’s a competition or a comparison when talking about money, but a meaningful discussion can still be had without going into details about your personal financial situation. Money is one of the few things that every human has in common in that we all need some level of it to meet our basic needs, and yet it is the one thing a lot of us are uneasy to talk about.

Fireside Chat #2: What do you wish you knew about finance at a young age?

I wish I knew that an impending market crash was going to happen in 2000 and 2008 so I could have dumped all my birthday money into put options just before the crashes and sold for hundreds of percent gains. Although, I probably would have needed my parents to co-sign for me to open a brokerage account, and that wasn’t happening considering I wasn’t even allowed Lunchables or Dunkaroos in my daily packed lunch for school.

Fireside Chat #3: How would you explain the power of compounding interest?

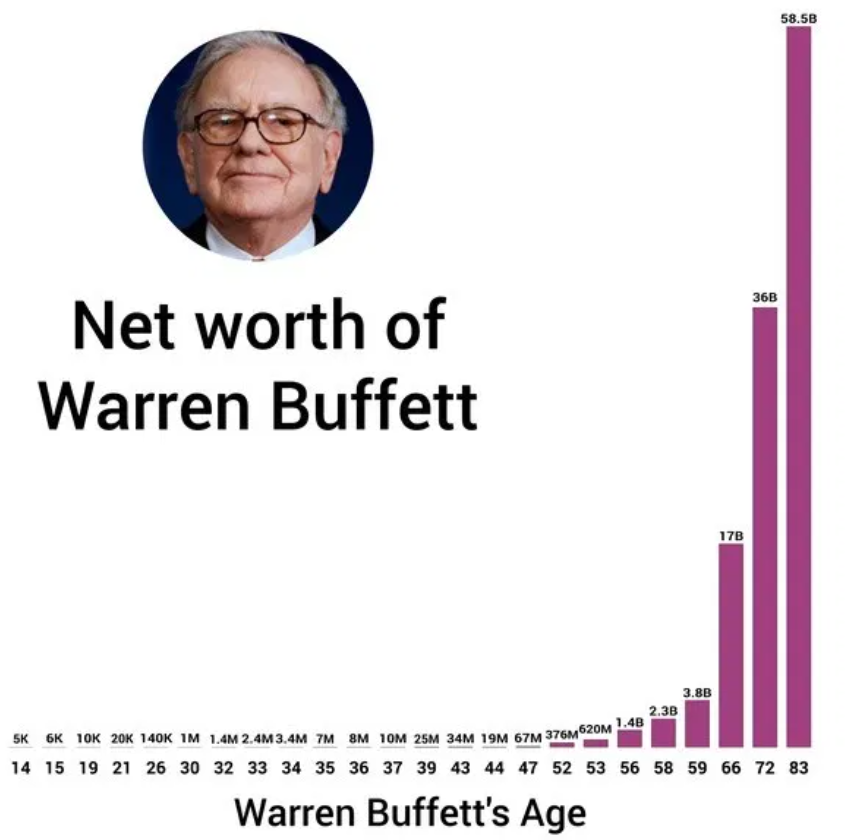

All the way back in Lesson 6, I discussed the power of compounding and saving money, even if it is a small amount to start with, at a young age. I also showed how Berkshire Hathaway has been able to compound its stock returns since 1965 to a gargantuan gain and outperform the S&P500 over the same time frame, and how differences in compounding interest rates can make a meaningful difference over a long period of time. The rule of 72 states that dividing an average annual return into 72 will give you approximately the number of years it will take for your money to double given that annual rate. Assuming the S&P500 returns on average 9% per year, a lump sum of money will double in 8 years, and this doesn’t take into consideration any additional contributions made to this lump sum of money over the same time period. Figure 1 below shows the growth of Warren Buffet’s net worth since he was 14 years old, as referenced in the Fireside Chat #3 video (not inflation adjusted, but the point about the effect of compounding over time remains the same).

Figure 1: Warren Buffet Net Worth Trend Over Lifetime

Fireside Chat #4: How should we be thinking about debt?

I always think this is an interesting question because I think you would get very different answers depending on the age demographic you ask. Older generations have lived through times of very high interest rates, and complimentary, high risk-free rates as well. As a result, the risk tolerance associated with paying off debt, even if it is servicing an asset like a house, would have been very low at the time. Whereas now, with sub 1% overnight bank lending rates and sub 2% fixed mortgage rates (as of December 2020), the risk tolerance associated with carrying mortgage debt over a long period of time is quite high. The ease to use leverage to grow your asset base and asset worth has arguably never been this flexible. However, this potentially could open the possibility to people overleveraging themselves and stretching their cost of capital affordability, which in the event of even a small interest rate hike would prove detrimental to their ability to service this debt.

Fireside Chat #5: City of Edmonton Budget Discussion with Jon Dziadyk

This last video in the fireside chat series was an enjoyable conversation we did with Jon Dziadyk, a current city councilor here in Edmonton, where we discussed the elements of the city budget, and questions pertaining to how budget decisions are made, current pressing budget issues amongst councilors, and why particular budget items are prioritized over others, especially during the COVID-19 pandemic. Although having insight into the city budget is interesting, there are parallels that can be drawn from a city budget to how a personal budget or balance sheet is constructed. The idea of creating a personal balance sheet and the importance this has on remaining financially disciplined is discussed in greater detail in Lesson 61.

I truly hope that these videos do provide value and awareness around various elements of personal finance in light of Financial Literacy Month. I hope these conversations can also act as reminder as to why managing your personal financial health is paramount to achieving financial success and independence over the course of one’s life.