Well, wasn’t 2020 a year for the ages.

Year in review: Bought some equities near the bottom in March, lost some money on goofy option strangle trades in my RRSP, officially gave up buying options and now only sell covered calls, sold Aphria because a merger with a crap company like Tilray isn’t my jam, got lucky and realised gains on a small crypto currency position, started the “Alternative Investments” section of my portfolio where I engage in the lucrative investment of sportscard sealed products and then sell it at higher prices to middle aged males addicted to opening packs of hockey cards, invested in a company where the CEO is now reportedly missing, and loaded up on blue chip dividend Dow Jones components in anticipation of the new Roaring 20s to come!

As I reflect on the craziness of 2020, I figured what better way to start off the new year by engaging in a self-fulfilling prophecy of proclaiming all of my new year’s resolution goals to the world in this article.

Actually, instead of that, after a volatile year in the markets, perhaps it makes sense to start off the new year by going back to basics and having a discussion about something very rudimentary: the definition of money.

Seems like a pretty silly question, perhaps even elementary. Money is the cash (or lack there of) in my wallet, right? Let’s get back to basics and look at the core of money, and understand how it functions in the global economy.

Simply put, money has three functions:

It is a store of value or wealth

It can be measured (unit of account)

It is a medium of exchange for a good or service

You give/receive money in exchange for receiving/providing a good or service. This is different than what was used hundreds of years ago where a bartering system was the means of transaction. The bartering system involves two parties exchanging goods. The biggest assumption here, and actually it’s a limitation really, is that the other party actually desires your good that you are willing to exchange for the good you want. For example, if I want a Lego set that a vendor is selling, under a bartering system I may offer them a pair of headphones. While the value may be comparable and therefore a fair-trade proposal, I am assuming that the vendor actually wants or needs my headphones. This limitation paved the way to what we now know as today as fractional reserve banking.

Fractional reserve banking refers to a system where only a fraction of the total bank reserves (or deposits) are available for immediate cash withdrawals to consumers. Banks use these deposits to lend out money to expand economic growth, while earning interest on these loans (i.e mortgage, business loans). The ratio of actual money available for withdrawal to total bank reserves is known as the reserve ratio. Typically, reserve ratios are in the range of 10-15% at retail banks.

There are qualities that money has that make it unique from a bartering system, and that make it “legit” to use as a medium of exchange. Money must be:

Readily acceptable

Have a known value

Divisible

Valuable relative to its weight

Noncounterfeitable

Now let’s take a look at why people would want to hold money. The most common reason is to make transactions and to BUY THINGS. However, money can also be held for precautionary reasons as in savings or for a rainy-day fund. Money can also be held for speculative reasons, where the risk in holding money is perceived to be less than the risk in any asset or investment currently available for purchase.

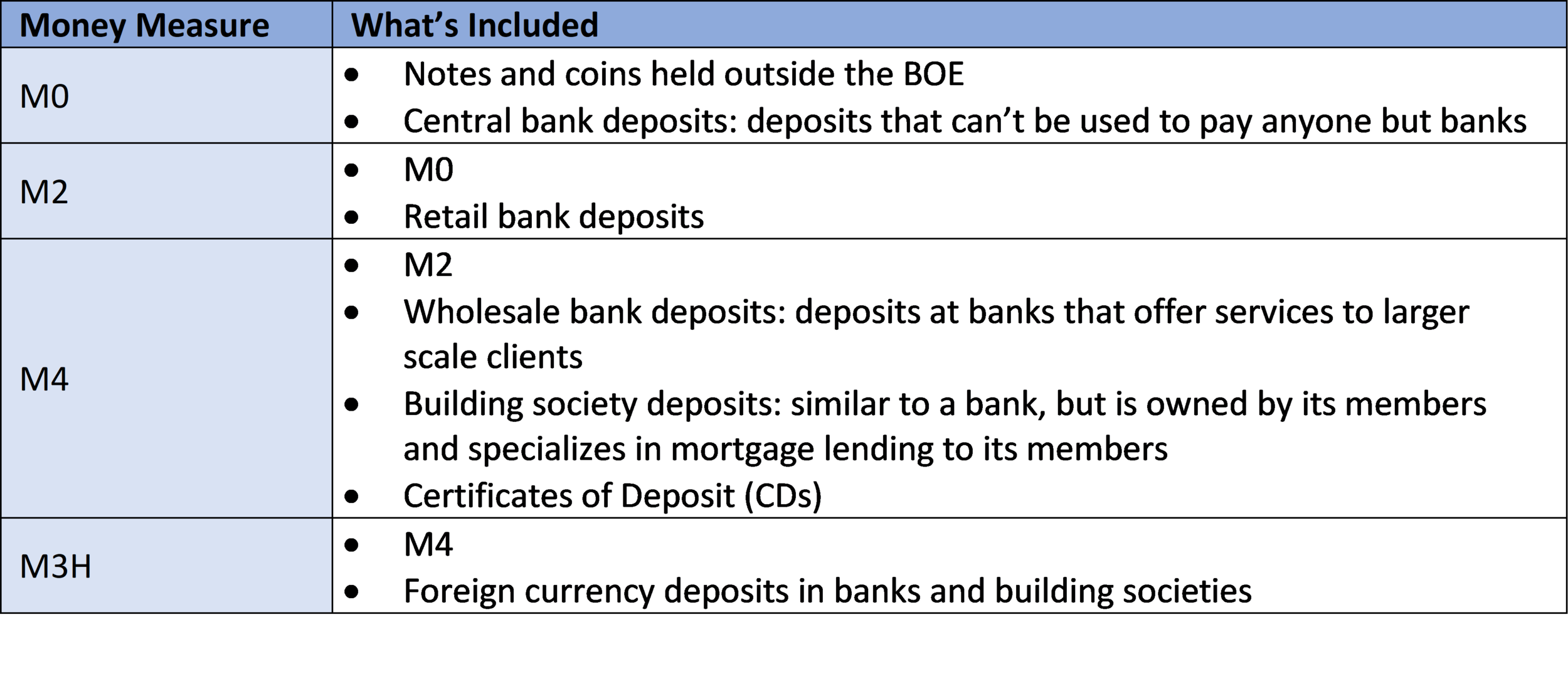

So this is how money is defined amongst consumers, but how is money defined across central banks around the world? Central Banks have a primary role of managing the overall money supply and price stability within an economy. They do this through monetary policy such as inflation targeting via a policy interest rate (overnight lending rate between banks), purchasing of government bonds, and by changing reserve ratio requirements for banks (refer to Lesson 65 for more details). Different central banks provide and report measures of money to give an indication of the level of money supply within the domestic economy. These levels can help predict inflation trends, economic cycle trends, and as a result potentially dictate future monetary policy and influence domestic fiscal policy. Below is a list of money measures produced by different central banks around the world that aim to reasonably measure the supply of money in the domestic economy:

US Federal Reserve, “The Fed”

European Central Bank (ECB)

Bank of Japan (BOJ)

Bank of England (BOE)

Money is defined in slightly different terms around the world, but they all stem from the same three primary functions of wealth storage, measurability, and a medium of exchange. The velocity, or movement of money, throughout the economy can be a bit more complex (and this is discussed in further detail in Lesson 22), but we all ultimately play a role in this money cycle as consumers. Now that we’ve covered the basics around the functioning principles of money, let’s start off 2021 with a fresh outlook on our money habits and personal finance decision making for the year. Let’s continue to make sense of making cents and dollars!