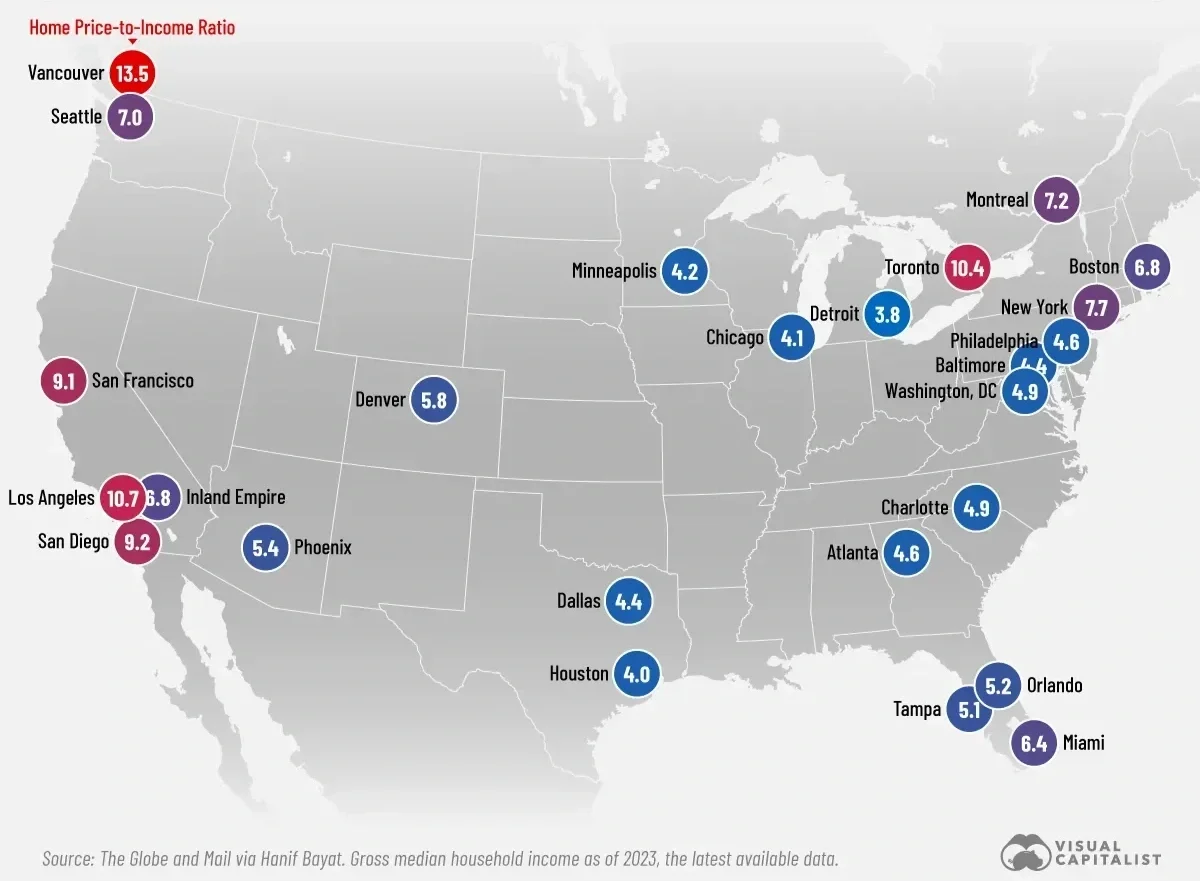

Housing affordability has become a critical issue in major North American cities, where home price-to-income ratios have surged to historic highs. Cities like Vancouver, Toronto, and Los Angeles are now among the least affordable markets on the continent, with median home prices exceeding ten times the median household income in these metropolitan areas (Global & Mail). This relentless rise in housing costs has put homeownership, and even affordable renting, out of reach for an increasing share of city residents.

As a result, the debate around rent control has gained renewed prominence. With market rents climbing rapidly and policy responses struggling to keep pace, many tenants, housing advocates, and even politicians have turned to rent control as a potential solution. This growing focus on regulation reflects broader anxieties about economic inequality, urban displacement, and the struggle to maintain vibrant, diverse communities in the face of mounting affordability challenges.

What is Rent Control?

Rent control is a form of regulation where local or state governments cap the amount of rent a landlord can charge tenants, or restrict how much rent can be increased annually. The purpose is to make housing more affordable and stable, especially in markets where housing demand outpaces supply. Rent control can include strict price ceilings (no increases at all), vacancy control (rents regulated even between tenancies), or vacancy decontrol (rents regulated only during a tenancy, but reset to market rates for new tenants). These controls usually cover private housing, not just public or subsidized housing (Rocket Mortgage, Doorloop).

Proponents for rent control include tenant unions, affordable housing advocates, and politicians addressing constituents concerned by rapidly rising rents. Their motivation is typically to:

Prevent displacement of existing residents due to unaffordable rent hikes.

Promote housing stability for lower-income renters.

Address concerns in cities where demand far outpaces supply and where market rents price out many working families

Rent control looks to solve affordability for existing tenants, predictability of housing costs for existing tenants, and a potentially increased likelihood of rental renewals, leading to better tenant retention and more predictable cash flow for landlords (JP Morgan).

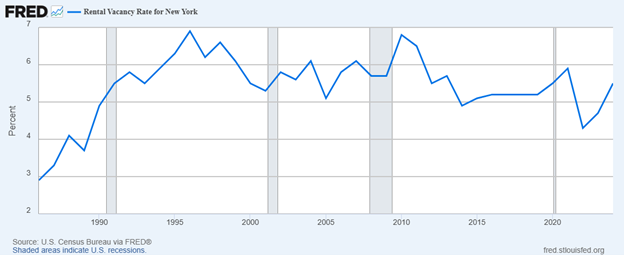

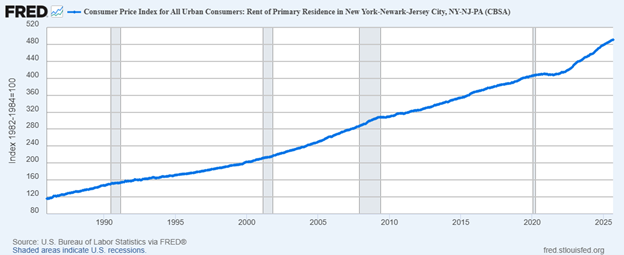

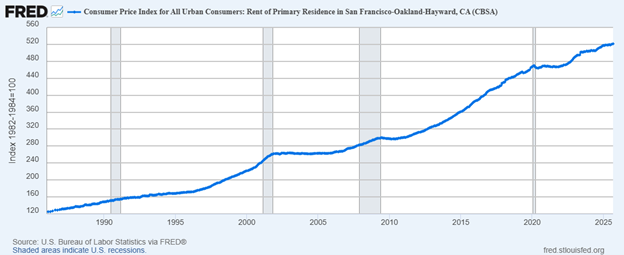

The graphs below show clearly the increasing cost of housing in major cities like New York and San Francisco, while vacancy rates remain low, fueling the motivations behind wanting to correct affordability in these hot rental markets.

Figure 2: Rental Vacancy Rates for New York City (1986 - 2025)

Figure 3: CPI Rent of Primary Residence in New York City (1986-2025)

Figure 4: CPI Rent of Primary Residence in San Francisco (1986-2025)

Does Rent Control Actually Work?

While well intended, many economists and investors argue that rent control can backfire due to several key reasons:

It discourages new construction and reduces investment in rental properties, leading to housing shortages

Landlords, facing capped profits, often reduce maintenance and property improvements, resulting in deteriorating housing stock

It creates inequities, rewarding existing tenants at the expense of new renters and distorting the intended benefits

Cofounder and co-chair of Oaktree Capital Management, Howard Marks, candidly reiterates these concerns, stating that, “Rent control sounds good in theory, but in reality it often depresses investment in housing, leading landlords to neglect maintenance or convert apartments to condominiums, worsening the overall housing situation”. He emphasizes that artificially suppressing rents can lead to less investment in new housing, and existing landlords may cut maintenance or find ways to remove units from the rental market, leading to overall stagnation and less mobility in the rental market. “Good intentions can’t overcome basic economic laws. By putting a cap on rents, you may help current tenants but discourage the very investment that would create more housing for everyone.” (The Memo by Howard Marks).

Several cities have tried and then rolled back or reformed rent control policies due to negative effects. A few examples are listed below:

New York City, US: Long-term rent-controlled apartments have often led to landlords neglecting maintenance, buildings falling into disrepair, and a shrinking supply of affordable rentals as landlords convert units to market-rate condos (Seeking Alpha)

Stockholm, Sweden: Strict rent controls created such a shortage that waiting lists for rent-controlled apartments extended up to 20 years, spawning a black market for leases (Journal of Housing Economics)

San Francisco & Los Angeles, US: After rent controls, property owners frequently converted apartments to other uses or raised rents on uncontrolled units, paradoxically driving up prices overall (Brookings)

Berlin, Germany: The city’s 2020 rent cap resulted in fewer rental listings and a sharp drop in available apartments, forcing repeal after it failed to improve affordability long-term (Journal of Housing Economics, Urban Institute)

While rent control can provide short-term relief, it is often associated with unintended consequences such as reduced housing supply, lack of investment, deterioration of the housing stock, and even higher rents in uncontrolled units.

What else could be done to improve housing affordability?

Economics 101 would tell us that if demand outpaces supply, costs will go up as more hands bid over limited available housing units. Therefore, simply increasing supply will help bring down prices of existing properties as competition over available units falls with fresh new inventory coming online. Also, reducing the cost to construct and difficulty for developers to build new properties (i.e. permitting) would in turn help bring down listing prices as developers can still maintain profitability. Reducing the rate of demand growth to be inline or less than the rate of supply growth would also help bring down prices over time. Everything noted here works in a perfect world free of regulation, but, without going into extreme detail, unfortunately a perfect world does not exist in most major cities where populations continue to rise and rental markets remain hot as supply falls behind. However, more new home construction and capital improvements of existing residential buildings certainly wouldn’t make the affordability situation worse.

Can Rent Control Actually Work?

The answer is… maybe… at least I think so. But just like anything in real life economics, nothing is black and white and caveats are needed.

Many long-term studies and economic research show that strict rent control rarely succeeds as a standalone policy. The negative effects on housing supply, quality, and market function tend to outweigh the intended benefits over decades. However, there are exceptions where nuanced or “soft” rent control, paired with significant public housing investment, has contributed to more positive outcomes, especially in recent decades (Brookings, Canadian Dimension).

Supporters of moderated rent regulation generally recommend pairing it with robust public or social housing builds, as these measures alone do not remedy underlying shortages or maintenance problems. The city of Vienna is commonly cited as a successful model, but its unique approach mixes moderate rent regulation with a massive public housing sector, with over 60% of residents living in municipally owned or regulated housing. Rent controls are just one element, with large, continuous public investments in affordable homes widely credited for the city’s long-term housing stability (Economic Analysis and Policy). Perhaps with this complementary public housing investment, similar systems in other hot rental market cities, such as New York or San Francisco, could potentially achieve some long-term success with housing affordability… easier said than done I’m sure.

While rent control is well-intentioned and can provide short-term relief for select groups, experience shows its unintended consequences often outweigh the benefits for renters in the long run, which can include housing shortages, reduced investment, and rental market distortions. However, limited or “soft” rent controls that allow for modest annual increases, combined with tax incentives and vast public housing, could help moderate the urban balancing act for major cities when well-designed for the long term

So who wants to elect me for their next city major… anybody? I guess I’ll stick with my day job instead.