It’s a new year and we are coming off of two spectacular years’ worth of market returns in North America. US and Canadian markets are at all time highs, a new administration is in the White House, inflation seems under control yet high prices continue to linger for common consumer goods, bond yields remain sticky supressing bond prices, the US dollar continues to be strong, and AI continues to be the catch phrase that everyone is talking about. Something has to be amiss, and markets should be seeing a downturn right around the corner, right?

Short answer: I have no idea. No one does. Why could there be a downturn? Why not?

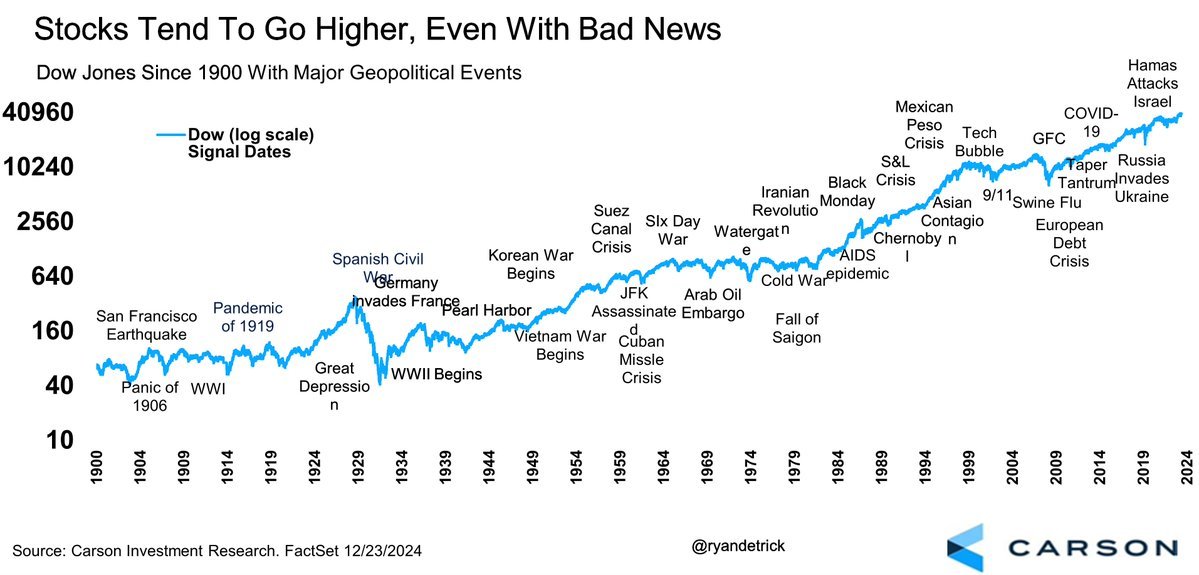

The main theme of this first post of 2025 is that there is always a reason to sell or be bearish.

This has always been the case throughout history. Over the long term, however, markets trend upwards. This may sound like blind optimism, but let’s think about this simply. If the expectations are that economies will grow, this means that the underlying businesses inside of them will grow. This is, after all, the goal of any business right – to provide value to society while maintaining economic viability and growing profitability over time? Businesses will continue to strive for profitability and then want to grow that profitability, which increases productivity and scale. As a result, civilization becomes more technologically advanced, efficient, and better off on average over time, and financial markets will reflect that. It pays to be bullish, or even an optimistic, long term, even if there are bumps and volatile periods along the way. I’ve really simplified what drives economic prosperity, but even thinking wholistically like this (let’s call it being a long term optimist for society and civilization) should make you remain bullish long term. I’m not saying economic headwinds won’t happen along the way, because they will and that is inevitable. But don’t let the short term gyrations in the market and heightened volatility during those times cause you to make emotional investing decisions in the moment.

To really hammer this point home on there always being a reason to sell, instead of orating paragraphs upon paragraphs throughout this post, I thought it would be fun and equally effective to simply show meaningful charts that all point to the same conclusion – remain invested long term and ignore the noise.

Let’s start with a history of the major US markets, and highlight key events around the world that would have provoked some investors to sell in the short term.

The next graphic shows a distribution of annual S&P500 returns since its inception in 1874 (to 2024) grouped into 10% buckets. For all of you stats nerds out there, the graph appears to be normal in nature with some shifting to the right. This makes sense since the average annual return for the S&P500 is ~7-8%, or positive in other words.

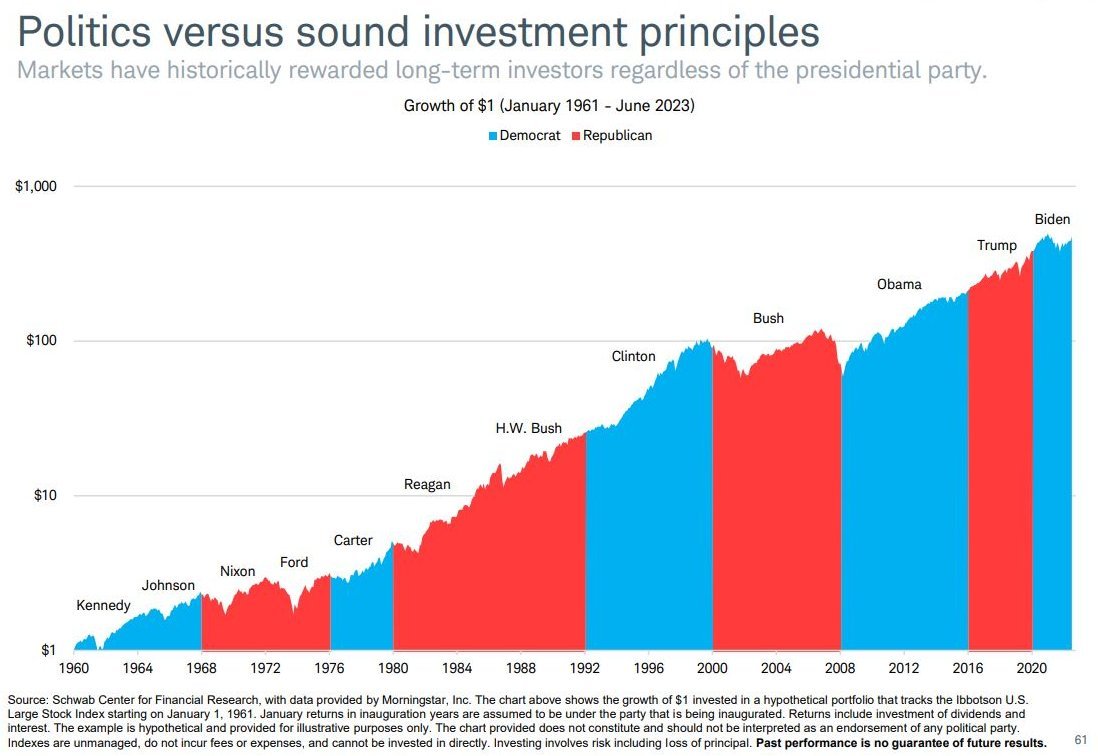

I always think of this next graph when investors get worried about whether they should change their long term investing strategy, or what they should be buying and selling, when a change in federal government takes place in Canada or the US. The short answer is it shouldn’t matter. Remaining bullish long term on the economy is the right approach. There have been equal numbers of recessions and expansions under both Democratic and Republican governments in the US.

This final graph clearly shows the correlation between long term earnings for US businesses and the S&P500 market returns over the same time period.

Here are some links to other S&P500 historical charts that compliment what we just covered:

Here we are starting the year with a new presidency and a whole new year of market activity. Will there be increased inflation with the threat of increased tariff policies? Will the USD remain strong against other currencies? Will markets remain strong following 2 consecutive years of 20%+ annual returns? I don’t know, and no one actually does. But I can say rather confidently that sticking to your existing long term investing strategy and owning quality business will pay you dividends (figuratively and maybe literally) over the long run, even with an inevitable series of unfortunate economic events along the way.