We are all everyday consumers in a global marketplace. The ability to purchase goods outside of our domestic country is as easy as ever, and the frequency in which people are moving around the world to work and live continues to increase. However, when planning for long term financial goals and eventual retirement, your purchasing power becomes an important factor to consider depending on where you are currently living, and where you will eventually be settling down.

So what exactly is purchasing power? Purchasing power is the relative strength of buying one asset in one market versus buying the same asset in another market. It can be thought of as your buying power, or the level of affordability a particular good has to offer. So what affects your purchasing power? I’ve come up with three categories that summarize what impacts one’s purchasing power:

Number one: Wealth

This is an easy one and pretty straight forward. The more wealth you have, and/or the more money you make, the more you can afford to buy. Consider two people living in the province of British Columbia, person A and B. If Person A makes an annual salary of $100,000 and Person B makes $80,000, then person A has more purchasing power relative to person B. Both earn and spend Canadian dollars, and both participate in the same economy or market, that being Canada, or specifically British Columbia.

Number two: Asset Price and Inflation

I’ve lumped both of these together since inflation affects asset prices. When inflation is present, asset prices increase, and therefore, with all else constant, purchasing power reduces for consumers. If person A and B are now purchasing assets at higher prices due to the presence of inflation, their purchasing power decreases granted that their salaries remain constant. One could argue that inflation causes wage growth over time which is true, but if the prices of goods increase at a faster rate than the prices of wages, then consumer purchasing power decreases. The opposite is true as well, in that if wages increase at a faster rate than the price of goods, then consumer purchasing power increases. Person A and B can afford less bananas if the price per kg increases from $1 to $2, given that their salaries remain at $100,000 and $80,000 respectively, and hence their purchasing power decreases.

Number three: Strength of Currency

This is a big one, especially for those living abroad or planning on moving to a different country to live and/or retire. A person earning wages in one country but spending in another currency may experience an increase in purchasing power due to the relative strength of the wage currency against other currencies. An easy example is looking at the exchange rate between the Canadian and the US dollar. Many Canadian travellers prefer if the US dollar is weak when visiting the US because their Canadian dollar can buy them more US dollars, or goods priced in US dollars. If the exchange rate between US and Canada is 1.24 USD/CAD, this means that for every 1 US dollar, 1.24 Canadian dollars can be exchanged for. If this ratio increases, then the purchasing power for US consumers in Canada increases because they get more Canadian dollars for every 1 USD.

Another scenario is when people work abroad in a foreign country with plans of moving back home to a different country. In this scenario, workers earn “foreign dollars” with plans on spending this in their home domestic country in the future, and therefore exchanging their earned foreign dollars for “domestic dollars”. Person A moves to the US and earns an annual salary of $100,000 USD. In Canadian dollars, this is larger than the amount they were earning in British Columbia which was $100,000 CAD. However, this is moot since Person A is living in the US and spending in USD. If Person A amasses wealth in USD over time, and then returns to Canada, they’re purchasing power in Canadian dollars will be affected given the exchange rate at the time of moving back to Canada. Person A will now be using their amassed wealth in USD and translating this back into Canadian dollars to now spend in British Columbia.

Let’s walk through an example to fully illustrate the factors affecting purchasing power.

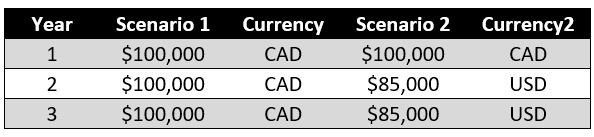

We will compare Person A in two different scenarios over the course of 3 years. In scenario 1, Person A lives in British Columbia for 3 years and earns $100,000 CAD per year. In scenario 2, Person A lives in British Columbia in Year 1 and earns $100,000 CAD, but moves to the US at the beginning of Year 2, and earns $85,000 USD per year, before moving back to Canada at the end of year 3. I’ve chosen hypothetical exchange rates and inflation rates at the end of each year to illustrate the comparison of purchasing power in Canadian dollars (domestic currency) across both scenarios. The table below illustrates this simulation:

Table 1: Scenario Wages Before Inflation Adjustment

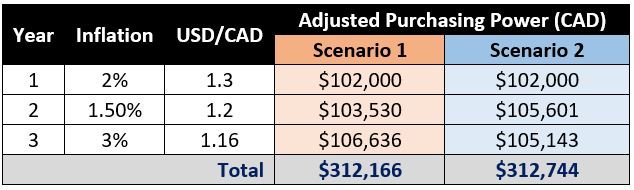

In each year, wages are adjusted for inflation cumulatively across all previous years, and adjusted for the current year’s exchange rate to CAD, as shown below in Table 2.

In year one, both scenario purchasing powers are equal. In year 2, scenario 2 purchasing power is higher given the exchange rate and inflation level decreases. However, in year 3, Scenario 1 offers more purchasing power because the exchange rate decreased from Year 2 while the inflation rate doubled from Year 2. Overall, at the end of the 3 years, both scenarios offer near equal purchasing power in Canadian dollars. It becomes quite evident how much the rate of change of inflation and exchange rate volatility has on purchasing power, even if wages remain constant over the same time period.

Purchasing power is an important factor to consider when planning your retirement, or considering your current financial position. One’s wealth level can be greatly fluctuating behind the scenes due to externalities such as inflation and foreign exchange rates, even if wages appear to be increasing and adding worth to one’s personal balance sheet. Even at a smaller scale, purchasing power is important to consider as a consumer in a global marketplace where international trade and exchange of goods between buyers and sellers across countries is inevitable and, in fact, pretty hard to ignore.