I do enjoy going to the gym to de-stress for the day, and to maintain a healthy active lifestyle. I don’t, however, have too many gains to show for it. My portfolio, on the other hand, is managed in such a way where I do strive to have plenty of gains (see what I did there?)!

Capital gains taxes are taxes that you pay on gains when you sell investments (i.e. realised gains). Capital gains tax is only paid on investment gains that are sold in a non registered account or non tax sheltered account. Gains realised in a TFSA are not taxed, hence the purpose of the TFSA itself. Standard cash, margin, or non registered accounts are subject to capital gains tax. Investments sold in an RRSP are not taxed, but funds pulled out of an RRSP will be taxed at the full marginal tax rate based on your current income level since funds going into an RRSP account are pre tax.

In Canada as of October 2021, capital gains tax is applied to 50% of the investment gains that are realised. Therefore, half of realised investment gains in a non tax-sheltered account are subject to tax at the highest marginal tax rate level based on your current income. This will depend on the province in which you live in as well.

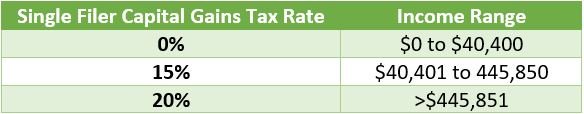

In the US, the actual tax amount is dependent on how long the investment was held for before profits were realised. Short term capital gains tax applies to gains realised on assets held for less than 1 year. Long term capital gains tax applies to gains realised on assets held for more than 1 year. Short term capital gains are taxed as ordinary income (i.e. marginal tax rate based on current income level). Long term capital gains tax rates will be less, hence incentivizing investors to hold assets and investments for longer periods of time.

No one likes to pay taxes right? So how can you avoid capital gains? Well, if you are managing a growing portfolio which you will be selling over time, the short answer is you can’t. However, there are some tactics that can be done to limit capital gains (the first two points below will be applicable to 99% of us, while the last 4 points are more unique and niche in nature):

If you plan on having short term investments or are wanting to trade shares more frequently, consider doing this in a tax sheltered account like and RRSP, RESP, or TFSA.

If you are realizing capital gains in a non registered account, consider offsetting these gains with capital losses. These are losses realised on investments held within a non registered account. Gains that are subject to tax in a non registered account during a given year are based on the net realised gains and losses from all investments throughout the year. If Heather sells stock ABC for a $1,000 gain, and also sells stock DEF for a $2000 loss, she has a net $1000 capital loss in her account. This loss can be carried forward into the next year to help offset any capital gains realised in that year, and so on. Capital losses can be accumulated over time to help offset capital gains going forward indefinitely. Capital losses can even be carried backward to apply to previous years’ gains up to 3 years. Be aware that in order for a capital loss to qualify, it has to be a “real loss”. You can’t just sell something and buy it back 1 month later. A real loss is defined as an investment that was sold for a loss and repurchased no sooner than 1 month later. This is essentially a 30-day blackout period in which an investor cannot repurchase shares they had previously realised losses on in order for the “capital loss” definition to apply. A trick around this is to do something called “tax-loss harvesting” where an investor has sold and realised a loss on an investment, and immediately purchases a “like investment” or similar company/asset to the one they just sold. For example, if Josh sells ETF A that tracks the financial sector for a realised loss, he can technically buy the next day a different ETF B that also tracks the financial sector.

In rare cases, capital gains can be deferred by transferring shares to someone else. This is only applicable for shares that are being transferred/received to/from a spouse or parent because of death or divorce. Capital gains tax will only be applied once the new owner of the shares sells them.

Lifetime capital gain exemptions applies in such rare and unique circumstances for a niche group of small business owners that I won’t even bother going into more detail. The rest of us, unfortunately, do not have this lifetime exemption… I wish!!

Shares can be donated to charity. This is actually a very tax efficient way of donating since there is no consideration of profit from the shares, and you also get a donation tax credit based on the market value of the shares at the time of donation.

A capital gain reserve can be held for capital property sales for up to 5 years. This applies to real estate classified as “investment properties”. Gains from the sale of an investment property can be spread over up to 5 years, and therefore reducing the amount of tax paid on the total gains amount over that time period. For example, if Lance sold an investment property for a $100,000 gain, he could pay tax on the gains realised in the current year, or he could spread this gain out into $20,000 portions over 5 years, and reduce the marginal tax rate he is paying each year. The one caveat in spreading capital property gains over multiple years is that the buyer has to also spread out their payments to the property seller over this same time period. This introduces default risk to the seller.

One could argue that there is a psychological aspect with the concept of capital gains tax, and the policy management around it from governments. There is some deterrent to trade frequently (and irresponsibly in most cases) in non registered accounts, for fear of having to pay capital gains tax within a given year. Frequent trading, including derivative and speculative trading, all run the risk of paying capital gains tax so quickly and frequently (within a given year). The buy and hold mentality for long term investments helps avoid having to pay capital gains tax within a given year, and prolongs having to pay such tax into future years where gains can be realised slowly in tranches, and in parallel with reduced income levels during retirement to limit marginal tax rates.

I’m not sure Robinhood traders and Shiba Inu crypto traders are aware of this mindset, but they will soon find out when filing their income taxes next year.