We are constantly bombarded with stock market news on a daily basis, from talking heads on BNN to brief elevator screen updates on market index movements. It’s likely that a portion of your managed portfolio is invested in US stocks, whether it’s traded on the NASDAQ, S&P500, or the Dow Jones. However, the Dow Jones is the “ugly duckling” of the bunch, and is structured very differently than most other major indices, including the NASDAQ and the S&P 500. This article will shed some light on the Dow Jones Industrials Average (DJIA), what it’s comprised of, and how being price weighted can make it an easy gateway to market manipulation by large “market movers”.

The Dow Jones Industrials Average, or DJIA, was started in the late 1800s. The DJIA is price weighted, unlike S&P 500 and NASDAQ which are market cap weighted. This means that the DJIA index is priced according to the actual prices of the underlying stocks within its index. Most markets around the world are market cap weighted, meaning that companies with larger market capitalizations (share price x shares outstanding) have bigger influences on the movement of the underlying index.

When the DJIA was started in the 1890s, the index was literally the average price of all stocks in it at the time, which was 12. The starting price was around $41!

Over time, a “Dow Divisor” was introduced to adjust the index to account for any stock share buy backs, share issuances, dividend payments, and any stock introductions or departures from the index. The Wall Street Journal is actually tasked with adjusting the Dow Divisor to properly reflect the DJIA’s historical accuracy. On April 2, 2019, the DOW Divisor was about 0.147, which means that for every $1 change in the price of a stock within the DOW, the DJIA itself will move 6.782 points.

If we used this divisor today (March 6, 2020), this means that the sum of the 30 companies within the DOW should equate to roughly 25864.78/6.782 = 3813.73.

Historically, the DJIA used to be comprised of mainly transportation and industrial sector companies, and other blue-chip names. Today, however, a large part of the index is shifting to more of a tech based focus to better reflect the nature of the US economy and where it is headed. As a result, over time, current DOW components will be replaced with different companies that better reflect the economic drivers in the United States.

As a matter of fact, the DJIA’s components have changed 54 times since its inception in 1896. In Table 1 below, I’ve shown the last 9 changes to the DOW that date back to the 2008 recession (the 10th change happened years prior to that in 2005).

Table 1: DJIA Last 9 Component Changes

You’ll notice some patterns of what was added versus what was removed when taking into context what the economy was like at the time of the company swap. For example, GE was seeing huge pressure from the markets because of its inefficient conglomerate business structure for the last few years leading up to it’s delisting from the DJIA. GE management was in the process of restructuring the business by merging business units, and spinning off low margin sectors of the company. GE stock performance, although slowly rebounding now from its 2018 lows, was quite subpar leading up to 2018. It was definitely seen as no longer being the world leading manufacturer like it once was.

Another pattern example is the replacement of AT&T with Apple in 2015. This was during a time when the technology sector was meaningfully gaining market share over other US sectors, and Apple was leading the way in its sector as its stock price continued to climb into 2015, and of course up until today.

Up to this point in the article, I hope it starts becoming evident that the DOW is simply an index with 30 select handpicked stocks to make the index appear as good as possible. Seems a bit “hokey pokey” doesn’t it? The top 10 companies (ranked in price) in the DJIA make up roughly 50% of the index, while the bottom 20 make up the other 50%. If “market makers” want to manipulate the DJIA, and other US indices, they only need to do so with the top 10 components. Think about that… to manipulate US indices made up of thousands of stocks, you really only need to move the top 10 in the DOW (and for arguments sake, the FANGS) to move US indices. This is exactly what the Plunge Protection Team (PPT) targets when intervening with markets.

…More on the PPT in a future article.

Companies listed on a price weighted index face a bit more challenges than companies listed on a market cap weighted index. Companies on the DJIA cannot just go out and split shares or buy back stock whenever they feel like it. Even to join the index, companies might have to change their share price or the number of shares outstanding when replacing another DJIA component in order to reduce the impact on the Dow Divisor. The new stock must either change its share price to that of the stock its replacing, or the divisor must be changed. Historically, there’s more resistance to changing the divisor. This is the exact reason as to why Apple had to split their stock 7:1 when they joined the DJIA in 2015. Other stocks may be forced to do stock splits when a new entrant comes into the index, just like Visa had to do when Apple joined (Visa did a 4:1 stock split when Apple joined the DOW). With the split, Visa’s ranking within the Dow went from 1st to 21st!

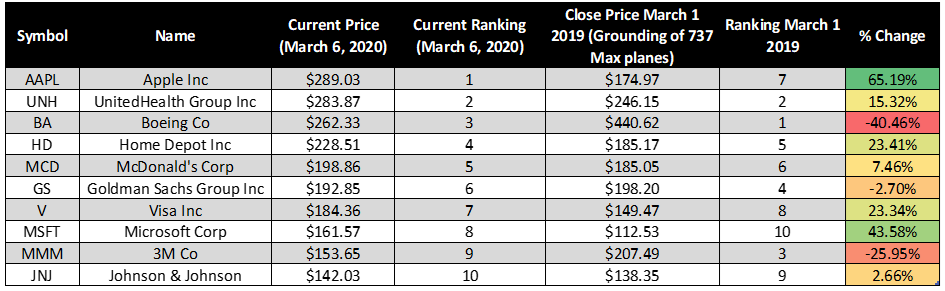

To elaborate on a company’s impact and influence in a price weighted index, it starts to become clear as to why the grounding of Boeing 737 MAX planes is such a big threat to the DJIA, as an example. Before the grounding of its planes, Boeing (BA) was the largest DOW component, and by a substantial margin too. Table 2 helps illustrate this (note that this list consists of the top 10 DOW components as of today on March 6 2020, and the ranking in Table 2 is a relative ranking of where these 10 stocks were relative to each other on March 1, 2019).

Table 2: DOW Top 10 Component Ranking March 1, 2019

After the series of plane crashes and the eventual grounding of all max 737 aircraft, the inevitable Boeing stock decline would be a major drag on the DJIA. The impact of the grounded aircraft fleet on Boeing’s earnings would take a while to eventually disappear, as the company will continue to investigate and invest millions of dollars to ensure that another crash on it’s 737 max fleet never happens again. So if you were a market maker and wanted to avoid this potential “drag” that BA could have on the DJIA, what would you do?

Simple… dilute BA’s influence on the DOW and lower its ranking. Interestingly enough, the next 5 largest DOW components have gone to the moon in share price since the BA incident, and on no particularly ground breaking positive news. Table 3 helps shed light on this “coincidental” reshuffling of DOW component rankings since March 2019.

Table 3: DOW Top 10 Component Ranking March 6, 2020

It’s evident that the DJIA is moving towards more of a tech and health care weighted index away from Boeing and an industrial/transportation heavy one. Hopefully by providing insight into the details of a price weighted index, compared to a market cap weighted one, this can help one understand what drives the movement of the DJIA, and how this price weighted construction alone allows the big market movers to influence market direction on all three US indices by focusing on just a small area of the DJIA.

Keep an eye on how the top DOW components behave over these next few months as markets head lower on revised earnings expectations, and remain volatile during the COVID-19 panic and oil price war between Saudi Arabia and Russia.