I define shiny things as distractions that people mindlessly meander towards without rationalizing their decision to do so. Buzz words are shiny things. Exciting new fads are shiny things. "Environmentally friendly!" "Gluten free!" "No money down for 16 months!" "Interest free!" "Zero light pollution!"

Corporate Social Responsibility (CSR) is a common theme amongst many publicly traded companies (and private too) where organizations will make an effort to invest or donate profits to a good cause to demonstrate this responsibility to social programs. Such social programs may include simple donations to local charities, or dedication to help solve a serious societal problem in a part of the world such as poverty or supplementation of basic needs to under privileged people. Whatever the cause may be, companies must be cognizant of the strategy they implement to carry out their CSR programs to ensure the programs are successful and make a difference, but also align with their own brand and company values, as well as effective in gaining customer and shareholder trust, buy in, and support.

Over the last few years, financial institutions have already started publicly announcing that they will no longer be investing their portfolios in unethical or non social responsible businesses, such as tobacco companies, or companies that produce landmines, or even flamethrowers! I can't even think of another purpose for a flamethrower other than to light things on fire.

However, CSR is also a term that is loosely thrown around as a Shiny Thing to attract investors to put money into a company or financial instrument. Research has shown that there are benefits to a business with having CSR programs such as attracting new investment, strengthening of a company brand and increase in revenues, and the development of a strong culture within the organization which indirectly can affect work efficiencies and cross departmental synergies. Yet, it may be argued that companies may carry out CSR initiatives with no real goal in mind, and simply do it for the sole purpose of optics. It looks good. "Hey look at us at ABC company where we manufacture toys, and we donate money to environmentally friendly initiatives in the energy sector." It's also difficult to gauge transparency of a business in their CSR efforts, especially for private corporations who are under no obligation to publicly report financial statements and details on social programs.

As an investor, it's important to invest in companies that not only have values that align with your own, but to invest in companies that have attractive business models and healthy profitability with the shareholder's best interests in mind. CSR can sometimes be seen as an advertising effort for companies to attract new investors to their stock, while not having a clear role or strategy around how they are supporting social programs or playing an effective role in such campaigns. Board of Directors and executive teams must come up with an efficient social purpose strategy where not only does the CSR initiatives have adjacencies to the business and associations to the customer, but also has acceptance by current and potential stakeholders and shareholders.

Let's take a look at some current "socially responsible" investments instruments. Below is RBC's "Vision Bond Fund" performance over the last 10 years. RBC says that Canadian assets in Socially Responsible Investing mandates represent $1 out of every $5 dollars under their management.

10 year Performance

Vision Bond Fund: 52.7%

TSX: 16.6%

S&P 500: 87.4%

Performance against the TSX is fantastic, but not so much against US market benchmarks. Also keep in mind that just because a social responsible investment (or any investment) has done great in the past, doesn't mean it will continue to do so in the future. This is the hot hand fallacy showing its ugly head again, as eluded to in Lesson 32 and 33.

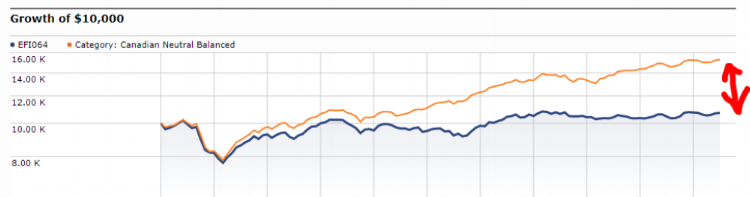

Here is another comparison between one of NEI's ethical funds against a balanced Canadian equity mutual fund. As you can see here, the ethical fund vastly underperforms the balanced fund.

The main takeaway here is not to be distracted and mesmerized with the shiny things, AKA the common "Corporate Social Responsibility" buzz phrase. If investing in a business with social programs is really important to you, don't blindly throw your money into the first fund with "social responsibility" at the end of the name. Do your own research and really learn how an organization is involved with a particular social program and what it offers to the benefit of society, to its own business and brand, as well as to its fiduciary duty to its shareholders. Many people do not want to talk about CSR and profitability in the same sentence, but keep in mind the sole purpose of why a person opens a business in the first place.... to make money. And if you are giving your money to this business, you want to ensure your money is being used in an efficient and ethical manner.