I almost had a brain aneurysm writing this post. After I finished writing it, I must have button mashed the keyboard somehow because the entire post deleted, and this domain space portal wasn't accepting my "undo" command, and as a result, I had to re write the entire thing.

Anyways, overspending is a very real issue. We all do it in small doses, and it's inevitable that we will all purchase something superficial or valueless over the course of our lives. However, developing overspending as a habit and trying to deal with it is a different problem on its own, and this is a problem for many Canadians.

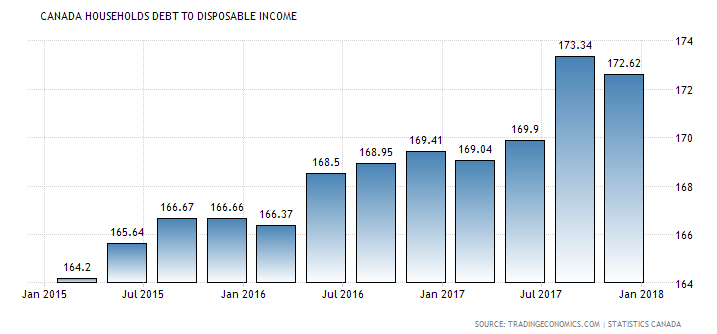

StatsCanada shows that average household debt to household gross income ratio is around 1.73 as of January 2018. In other words, for every $1 earned as gross income (pre tax), there is $1.73 outstanding debt for that household. Now this statistic not only accounts for mortgage debt which will make up a huge chunk of any household debt level, but it looks at gross income. To me this is meaningless since take home pay is what you actually see (aka net income after tax dollars) and what you actually use to PAY down debt with.

Figure 1: Historical Canadian Household Debt to Gross Income Ratios (%)

To get a more realistic sense of overspending, we need to look at consumer debt, or non mortgage debt. Many articles claim that Canadian consumer debt is high and will not stop growing anytime soon. Well what exactly is high? Based on a survey from Equifax done in September of 2017, the average personal debt per Canadian is roughly $22,000, with Alberta showing the highest provincial levels per person at $28,000. The majority of this debt is comprised of credit card debt and installment loans. Keep in mind that this debt is subject to interest rates that range anywhere from 19% credit card interest rates to 200% APR (annual periodic rate) on payday loans...!!! This is absolutely insane.

Overspending is obviously not a one off case, and is a problem that affects many Canadians. Here are a few tactics to combat and avoid over spending.

Firstly, if overspending is a gargantuan issue, avoid using credit cards. Take your credit cards and cut them up, bend them, feed them to your neighbour’s annoying dog, do whatever it takes to get rid of them and to avoid using them. We want these out of sight and out of mind to make sure these plastic “conveniencers” are not utilized. I always think of a credit card as a delayed payment debit card, because you will essentially have to pay for an item regardless of the method of payment, it just depends on how long this payment will be prolonged for.

Get into the habit of using cash for regular expenditures. Whatever regular transactions that would prompt you to reach for your credit card, use cash instead. You will get a much better idea of how much you are spending when you are physically holding cash and giving it to the merchant’s hand instead of using plastic. You don’t get this kind of emotional connection when using a credit card.

If you are somewhat more responsible with using a credit card and have the every so often outstanding balance at the end of each month subject to interest, start paying off outstanding credit card bills on a weekly basis. This will get you into the habit of tracking expenses on a regular weekly basis, and ensuring that you will always have an outstanding monthly balance of zero on the credit card. Now I know this totally goes against the time value of money concept, but that becomes less important here when the objective is to reduce overspending. Start tracking your revenues and expenses on a weekly basis. Start keeping a balance of all your assets such as the value of your house, cash in your bank accounts, investment accounts, retirement savings, and vehicle (although I don’t include this at all since I don’t consider a vehicle as an actual value asset... see Lesson 11), and your liabilities such as outstanding mortgage balance, and credit card debt. Subtracting liabilities from your assets will give you your net equity or your net worth (subtracting outstanding mortgage from house value will give you the equity paid into your house). Track this on a weekly or biweekly basis and make it a mission or goal to try and always increase your net worth balance every week. Treat yourself every time you accomplish your weekly goal (as long as it doesn’t increase your personal debt levels). Try to enjoy doing this and seeing your net worth expand!

Lastly, please whatever you do, do not ever use the services of a MoneyMart, Mogo, iCash, or whatever fraudulent excuse of a company these criminal organizations stand for. Pulling out $400 at 11% weekly interest rate is absolute grand larceny, and these companies are always getting the last laugh at unsuspecting consumers who simply want access to a quick few hundred bucks. Don’t fall for these mesmerizing and easy access to quick cash schemes. The easier it is to borrow money from a lender with lesser restrictions, the higher the interest rates will be. Simple as that. Payday loan companies expect high default on their loans, and therefore to cover this borrowing risk, they will charge high interest rates. Do not ever enter the premises of one of these scam artist organizations. You might as well mine cryptocurrencies from a server in Estonia with no guarantee on your principal investment (wait I think I've done that before...).

Following these few simple tactics will help avoid and eliminate unnecessary and irrational overspending problems in the future. Doing so will help you see your net worth gradually increase overtime and put one at ease in terms of financial stress and unwanted high consumer debt levels. Overspending is like operating the money gun at a Vegas casino blackjack table, but chances are, the house will get the last laugh.