Usually when I talk about getting gains, I’m often referring to my continued unsuccessful attempts to build muscle mass at my local gym. However, there is another type of gains that is also a welcomed accomplishment, and one that is bound to happen with long term investing -capital gains.

Capital gains are defined as the profit made from selling a capital asset, such as stocks, at a higher price than the purchase price. As referenced in Lesson 96, capital gains tax rates vary depending on the holding period of the investment and the investor’s income level. Capital gains are only taxable if they are realized in a non registered (taxable) account. Capital gains are not subject to tax in a registered tax free or tax deferred account, such as a TFSA, RRSP, or ROTH IRA.

Building off of our discussion from Lesson 75 Getting Gains, this lesson will further breakdown what short term and long term capital gains rates look like both in the US and in Canada for local residents. We will also summarize the different types of withholding taxes for non residents investing in stocks across the border (i.e. Canadian residents investing in US stocks). For the purposes of this article, we will only consider federal tax rates, and ignore additional provincial & state taxes.

Capital Gains in the US

Short-Term Capital Gains (US): Short-term capital gains are realized from the sale of an asset held for one year or less. These gains are taxed as ordinary income. The tax rates depend on the investor’s federal income tax bracket, which ranges from 10% to 37%.

Figure 1: US Short Term Capital Gains Federal Tax Rates

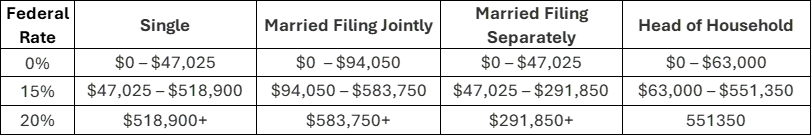

Long-Term Capital Gains (US): Long-term capital gains are realized from the sale of an asset held for more than one year. These gains are taxed at reduced rates compared to short-term gains. The rates are determined by the investor’s taxable income and filing status:

Figure 2: US Long Term Capital Gains Federal Tax Rates

Additional Considerations (US)

Withholding Tax: These are taxes that are imposed for American residents investing in Canadian stocks and other assets.

State and Other Taxes: Each state will have its own tax rates, which is added to the federal tax rate. State tax ranges from states with no income tax, to states with a flat or gradual rate income tax structure. A Net Investment Income Tax (NIIT) of 3.8% may also be applicable for some high income earners. For the sake of simplicity and purposes of this article, NIIT and state income tax are not discussed.

Capital Losses: Capital losses can be used to offset capital gains in the same year. Unused capital losses can be carried back three years or carried forward indefinitely to offset future capital gains. Capital losses that exceed capital gains in a year may be used to offset capital gains or as a deduction against ordinary income up to $3,000 in any one tax year. Net capital losses in excess of $3,000 can be carried forward indefinitely until the amount is exhausted.

Principal Residence Exemption: The sale of a primary residence is only exempt from capital gains tax in the United States if the owner has owned the house for more than 2 years prior to selling.

Example Calculation: For an individual with a long-term capital gain of $50,000 who is single and has a total taxable income of $100,000 in 2024. The gain falls within the 15% long-term capital gains rate bracket.

Federal Tax:

First $11,600 at 10% = $1,160

Next $35,550 at 12% = $4,266

Next $52,850 at 22% = $11,627

Plus $50,000 capital gains at 15% = $7,500

Total Federal Tax = $24,553

Capital Gains in Canada

Unlike in the U.S., Canada does not differentiate between short-term and long-term capital gains. All capital gains are treated the same regardless of how long the asset is held. In Canada, 50% of the capital gain is taxable. This is known as the inclusion rate, and is included in your taxable income. The taxable capital gain is added to your total income and taxed at your marginal tax rate, which depends on your total income for the year. Marginal tax rates in Canada vary by province and income level. Federal rates for 2024 are:

Figure 4: Canadian Capital Gains Federal Tax Rates

Additional Considerations (Canada)

Withholding Tax: These are taxes that are imposed for Canadian residents investing in US stocks and other assets.

Provincial Tax: Each province also has its own tax rates, which are added to the federal rates. For the sake of simplicity and purposes of this article, provincial income tax is not discussed.

Capital Losses: Capital losses can be used to offset capital gains in the same year. Unused capital losses can be carried back three years or carried forward indefinitely to offset future capital gains.

Principal Residence Exemption: The sale of a primary residence is generally exempt from capital gains tax in Canada.

Example Calculation

For an individual with a capital gain of $10,000.

Taxable Capital Gain: 50% of $10,000 = $5,000.

Taxable Income: The $5,000 is added to the individual’s other income for the year and taxed at their marginal tax rate.

If the individual's other taxable income is $70,000:

Federal Tax:

First $55,867 at 15% = $8,380

Next $14,133 at 20.5% = $2,897

Plus $5,000 capital gain at 20.5% = $1,025

Total federal tax = $12,302

Understanding these rates and rules can help investors manage their portfolios more tax-efficiently by timing the sale of their assets to maximize tax benefits, and help investors make more informed decisions about buying and selling investments. Having investments in both registered and non registered accounts, while ensuring contribution limits are maxed for tax free registered accounts, can help optimize an investor’s after tax returns when liquidating for retirement, emergency, or alternative asset allocation purposes.

In addition, there’s generally no withholding tax on capital gains, except for specific types of real property interests. Understanding these withholding tax rates and the benefits provided by the Canada-U.S. Tax Treaty can also help investors plan more effectively and minimize their tax obligations on cross-border investments.

Because as a prudent and patient long term investor, capital gains are the only type of gains that you can confidently plan for getting more of.