Many people always ask the age-old question, “How do I become rich?” Well unfortunately, there is no magic quick formula to become immediately wealthy. Some people are born into wealth, and others get lucky. What can I say, life isn’t fair. For the 99% of us, what is fair and within your control is to manage how you spend your money and take care of yourself over the course of your life to ensure financial independence by retirement.

I’m sure you’ve seen plenty of advertisings on TV or on finance sites about “how to become a millionaire” or “the top traits of rich people”, and all you have to do is to follow those exact behaviors and you will be successful. There’s some merit to these claims, and, well, you’re going to see the exact same topic here! Except what I will try to do is to sum everything that I’ve read and witnessed into 3 simple habits amongst most financially independent people that I truly believe are realistically achievable. I will use the term “wealthy” and “financially independent” synonymously here as I do believe a realistic financial independence picture will look different for every person. Being wealthy doesn’t have to mean you live in a $20MM mansion with 3 Aston Martins parked out front and a closet full of Giuseppe Zanotti sneakers.

Number 1: Spend Less than you Earn

You were expecting something revolutionary, weren’t you? Well sorry to disappoint, but this is a simple yet crucial rule to ensure financial independence over the long term. I harp on this point time and time again on this blog site, and the reason I do so is because when I see how high the average personal debt is in Canada, and the number of people only hundreds of dollars away from insolvency, it tells me that many individuals are not following this simple rule. People don’t become financially independent by simply making a decent salary (although it sure helps). There’s a running joke amongst some friends of mine that the best way to prevent someone from becoming a millionaire is to pay them a comfortable salary. Spending less than you earn will always mean you have money left over in your pocket. This money can be for retirement savings and investments, tuition, rainy day funds, or simply some money for entertainment expenses.

Number 2: Buy and Own Assets

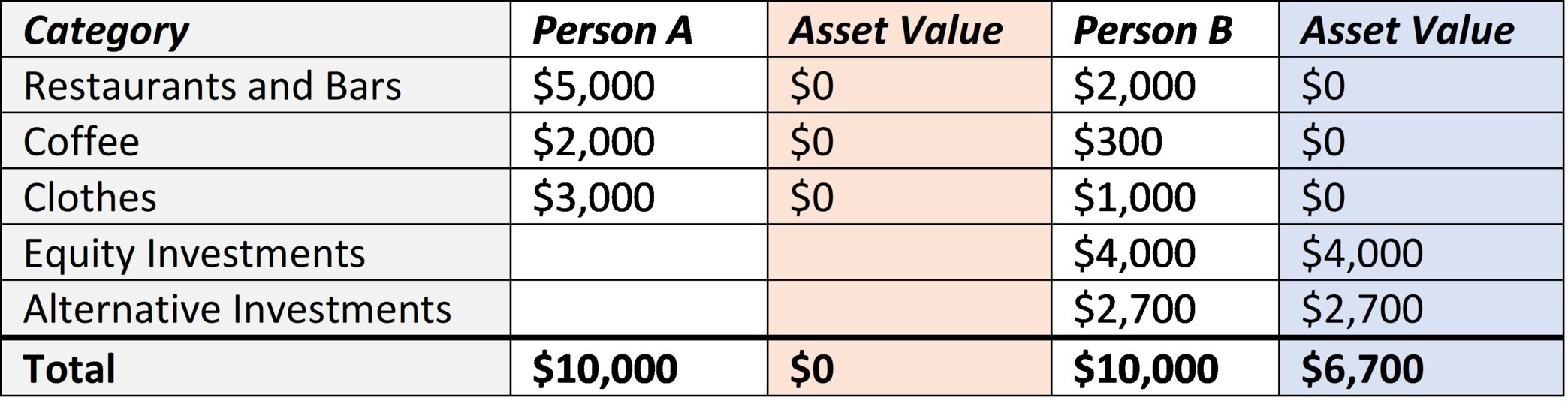

This is probably the most common trait that I have witnessed amongst financially independent people, and it’s the ownership and holding of assets that increase in value over time. This is a mindset shift for some people, as spending money isn’t always a “frivolous” activity because it somewhat depends on what you are purchasing. Let’s consider two individuals, Person A and Person B. Each are given $10,000 for the year to spend on whatever they want. Person A spends $5,000 on eating out at restaurants and bars, $3,000 on clothes, and $2,000 on coffees (this is pretty standard for the average Starbucks cardholder). Person B spends $2,000 on restaurants and bars, $1,000 on clothes, $300 on coffee, $1,000 on an original art piece, $4,000 on a market ETF inside their TFSA, and $1,700 on a piece of high end furniture. Both spent their $10,000, but Person A has nothing to show for it. The value of what they purchased is $0. Person A can’t liquidate their food and entertainment expense (that just gave me some weird imagery with the words “liquidate” and “food” in the same sentence). Person B on the other hand has assets that hold value. Person B still spent money on entertainment, but limited their budget in that category to purchase other assets and investments. Person B owns $6,700 of assets that will likely hold their value, if not go up in value, over time.

Table 1: Asset Purchase Comparison

A good habit to have is to spend money on things that hold value, and hopefully go up in value over time. This can be as simple as equity investments, alternative investments, or things for your home.

Stock investments

Bonds

Land, property, real estate

Alternative investments – furniture, art, hobby (will discuss more on this in a future lesson)

There is no reason for a 20 some year old to go out and finance a $60,000 vehicle with a 10% down payment and monthly interest payments. What value are you actually owning at that point, and how much are you paying over the course of ownership towards the financing compared to what the vehicle is worth when the loan is paid off?

Number 3: Take Care of Your Health

Yes, I am talking about a habit that directly has nothing to do with money management… personal care is extremely important, both physically and mentally. It’s easy to forget self care when you are knees deep in managing your finances and other facets of your life. Taking care of you is so important to the long-term health of your body. It’s important to build these habits into your lifestyle at a young age, because it will pay dividends to you when you are much older and CAN’T physically work anymore and earn income. I don’t want to sound like one of those nutrition New York Times best seller books, but your body is like an investment, heck it’s like a stock investment! The more you take care of it now, the more it will set you up for success later down the road, even if you don’t fully appreciate all the hard work you are putting in right now.

Eat well and exercise

Maintain consistent sleep schedule

Meditate, get a massage, or take part in some other therapy to help clear your mind

Having a clear mind and feeling physically energized will not only make life’s challenges more manageable, but hopefully make money management decisions much easier and less stressful to do, which is crucial to maintaining the path towards financial independence by retirement. And that certainly is something we all have in common to strive for.