I suppose the majority of people wouldn’t consider talking about money management as a tantalizing topic to express deep thought and expression towards. While I sit at a public coffee shop today hearing conversations in the background about celebrity Instagram accounts, the Bachelor, festive pet costumes, endangered species, or other things that I don’t find remotely interesting, as R Kelly once coined, my Real Talk today is about Real Estate Investment Trusts, or REITs for short.

Before getting into the bread and butter of REITs, I want to go over the two different types of dividends. For the purpose of this article, I will try as much as possible to simplify dividend and cash distribution tax rules, as it can get pretty complicated depending on where the income to the shareholder is coming from, and what jurisdiction the source’s tax structure falls under.

Dividend Types

There are two types of dividend classes: eligible and noneligible.

Eligible dividends are dividends that are paid out by companies to shareholders that are subject to the provincial and federal tax credit. Typically, any dividend that is paid out by a publicly traded company will be an eligible dividend. As a shareholder, to receive this dividend tax credit, the equity holding must be held in a non registered account. I won’t get into details around how the tax credit is calculated, but it essentially helps offset the double taxation of dividends having flowed through a company’s income statement, and then being taxed a second time as a part of the shareholder’s income for the year. This “offset” is only applied to eligible dividends paid out in a non registered account like a margin or cash account. A shareholder will not receive any tax credit (nor will they be taxed, or taxed immediately) on dividends paid out in an RRSP or TFSA.

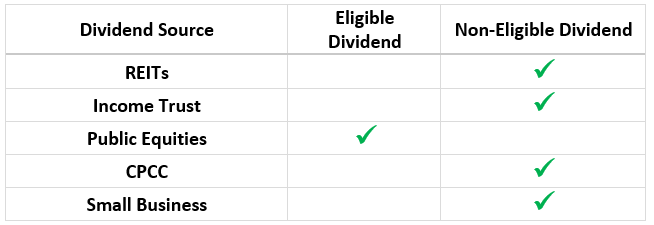

Non eligible dividends are simply the opposite of eligible dividends where these dividends are not eligible for the shareholder to receive a dividend tax credit in a non registered account. Any dividend or contribution paid out from REITs or income trusts typically fall under the non eligible dividend category, as these pay outs are subject to standard marginal tax rates. Dividends paid out from income that has been subject to a small business deduction already, or have been paid out by a Canadian Controlled Private Corporation (CCPC), are also classified as non-eligible. Table 1 summarizes the eligibility of dividends from different sources:

Table 1: Eligibility of Dividend Sources

Like I mentioned earlier, eligible dividends are subject to a tax credit, so think of that as a reduced tax rate on the dividends. Non-eligible dividends are not subject to this tax credit. Most of the time, non-eligible dividends are taxed at the shareholder’s marginal tax rate, or the tax rate at which your additional dividend income on top of your ordinary personal income gets taxed at. This is obviously dependent on what tax bracket an individual sits in with respect to their personal income.

The reason I say “most of the time” will become evident when we dive more into REITs.

On a side note…

For comparisons sake, unlike dividend income, capital gains, or realised gains upon selling equity holdings, are taxed at a lower rate than dividends and interest. Capital gains are taxed only on half the capital gain amount. Again, the total amount of tax applied to this half of capital gains amount is dependent on how much you earn from personal income and other sources. Capital gains are only applicable in non registered accounts. This is one of the benefits of having investments in a TFSA or RRSP to accumulate large capital unrealized gains over time. Capital losses are the opposite where an investor realises a loss on an investment. Capital losses can be used to help offset capital gains in a non registered account to reduce the amount of tax paid on capital gains.

Finally, to complete my investment income picture, interest income is fully taxable at the marginal tax rate. Interest income can come from fixed income securities like bonds or treasuries.

Real Estate Investment Trusts

REITs, or real estate investment trusts, are equities (typically publicly traded) that an investor can purchase that will provide the holder with a steady stream of income, usually via monthly or quarterly cash distributions. REITs allow an individual to invest in a diversified real estate portfolio without having to put up the extensive capital that is needed to purchase real estate investments themselves. In Canada, REITs are required to pay out 90% of their net income in the form of cash distributions annually. Because of their nature, REITs don’t typically appreciate much in share price year over year, but will provide a steady stream of income to an investor.

There are three types of REITs:

1) Equity REITs – these companies manage, operate, and invest in real estate property

2) Mortgage REITs – these companies focus more on providing financing for real estate where they lend money to property owners, like a mortgage, and receive interest as income (purchasing of mortgage backed securities falls under this type of REIT but let’s forget about those for this discussion)

3) Hybrid REITs – these are a mix of equity and mortgage style REIT operations

REITs pay out 90% of their net income annually to shareholders in the form of cash distributions as opposed to eligible dividends. In other words, income from owning REITs fall under the non-eligible dividend category.

Remember before when I said non eligible dividends are “most of the time” taxed as normal income? The 90% of net income that gets distributed to shareholders can consist of different income that the REIT received that period and would have stated on their income statement. When you receive this distribution, its mix up will dictate how you get taxed on the cash distribution. The cash distribution can be comprised of the following:

· Capital Gains - realized gains upon selling equity holdings that are taxed at a lower rate than dividends and interest. Capital gains are taxed only on half the capital gain amount

· Foreign and other income – taxable at marginal tax rate

· Return on capital (ROC): exists when a REIT pays out more than the net income it has earned for that period to meet its cash distribution obligations; in other words, the shareholder is getting paid back some of their original investment, and therefore will not be immediately subject to tax on this amount. ROC portions of a cash distribution are non taxable in the year the investor receives it. However, over the long term, ROC reduces the average cost basis (ACB) of the REIT investment for tax purposes. As a result, over time this will lead to increased capital gains or reduced capital losses upon disposal of the REIT. If the average cost basis of the REIT investment is reduced below zero during the tax year, the negative amount is deemed to be a capital gain in the year it arises. Any future ROC distributions will be taxed as a capital gain as well because the shareholder is getting back more than they originally invested. The ACB of the REIT is always returned back to zero.

Sound confusing? Don’t worry… that’s because it is, and for the everyday investor, these details are probably not important. It is good practice to understand at a high-level where the cash distributions come from and that taxation on this income can vary depending on what sources of income it comes from. Figure 1 highlights the make up of REIT cash distributions:

Figure 1: REIT Cash Distribution Makeup

As a Canadian investor, you can also own US REITs, but there is a 15% withholding tax applied to dividends paid out from US REITs held in a non registered account. These dividends are classified as foreign dividend income and will be taxed at the marginal income tax rate. However, there is no withholding tax on foreign dividends if the US REITs are placed inside of an RRSP. As is the case with any RRSP withdrawal, US REIT dividends will only get taxed once withdrawn from the RRSP, and will be taxed as regular income.

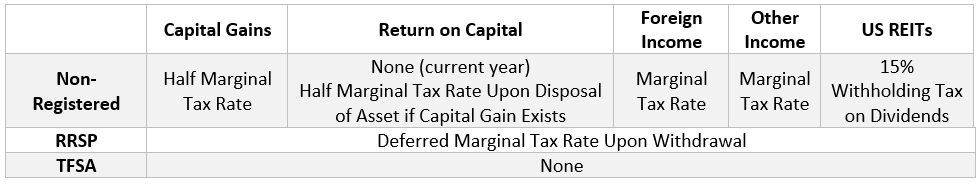

Table 2 summarizes the tax implications in each account type for the different components of a REIT cash distribution.

Table 2: REIT Cash Distribution Taxation Summary

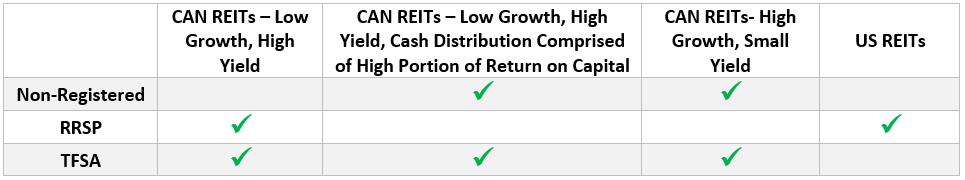

Taking all of this into consideration, Table 3 summarizes the optimal Canadian investing accounts to house different types of REITs.

Table 3: Optimal REIT Placements

In summary, REITs are great instruments to own for steady periodic income streams that do not require intensive capital to get exposure to a diverse real estate portfolio. Cash distributions from REITs are not classified as eligible dividends, and should be placed into tax advantaged accounts. These are good things to be mindful of when planning on where to purchase a REIT. For any investment, being mindful of the taxation rules and dividend eligibility around it can save you ample costs over the long term and ensure you are getting the most optimal return for your dollar. Now that’s real talk right there.