Ever hear of the herd mentality? Following others around like sheep and mimicking their every move because that appears to be what the majority of people are doing? Sounds pretty silly to not think for yourself and just monkey the actions of everyone around you, right? So why do so many people do this with investing?

A significant part of market volatility and price movement is due to trader emotions. When junior investors see a large rise in the markets, they want a piece of the action so they buy in. By then, it's already too late as the market has eked out the last bit of gains its got left, and begins to fall or correct back down to proper valuation levels or historic means. By this point, the junior investor begins seeing their newly bought equity position start to fall and fall and fall into what seems to be a never ending downward spiral trend. What do they do? They sell their security for a big loss. By this point, the market has fallen so much that most downward pressure is gone, and positive sentiment and value investors (or just simply smart people) start buying back in, which begins driving up the market once again. The junior investor is now sitting on the sidelines with a realized loss in their account, feeling pretty burned from the market and will either choose to never invest again, or continue to trade on emotions and buy at highs and sell at lows. Time and time again, this has proven to be the number one most common mistake that beginner investors make.

This is a perfect example of confirmation bias, where the majority reacts in a certain way or has some preconceived notion about a certain decision, and you go along with it just because everyone else is. Many big companies try to identify this issue within their organization when it comes to decision making amongst teams or leaders. Overcoming confirmation bias allows one to think and act independently and come up with a resolution to a certain problem independent of what the rest of the team may have already agreed upon or decided. Allowing market trends to dictate emotional trading is no different.

Trading on emotion can cause investors to do crazy things and act quite irrationally, which isn't the state of mind you would want to be in when making important money management decisions! On the upside, the proclaimed "fear of missing out" mentality kicks in where an investor wants a piece of the action. However, on the downside, you feel like you've been left with holding a loser in your hands and have a fear of missing out on potential unrealized gains or limited unrealized losses. Therefore, you instinctively sell. At that moment, you feel relieved. However, in hindsight when you see the market rebound and continue a bullish trend for the next 3 years, you realize your bad decision. Even in hindsight when we realize our past mistakes, many people tend to repeat these same emotional trades over and over again. How do we overcome this challenge of ignoring our emotions when it comes to investing our money?

Simple. Buy and forget. Stop looking at your account. Dollar cost average into the market at predetermined regular intervals throughout the calendar year, so no matter how the market is behaving, you are buying in. Investing is done over a long period of time, and usually for long term saving and retirement. You will most likely have seen markets operate for 10 to 30 years before you pull it out for retirement (depends how old you are now of course!). 10 to 30 years!

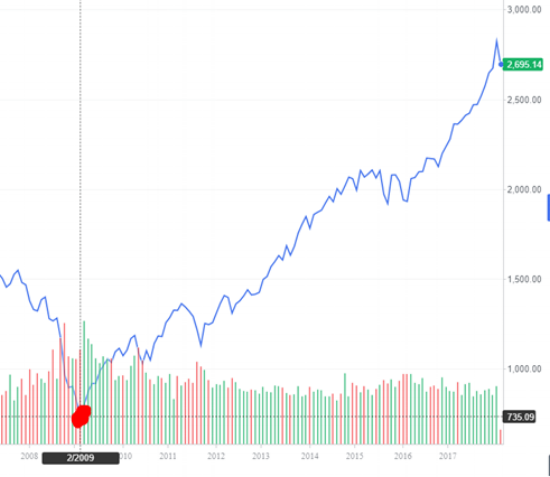

Look at the 2008/2009 financial crisis. There was a period of a few months where markets were hugely volatile, seeing new 1 year lows across most indices. However, looking out even just 6 months past the market lows and crazy volatility, the markets already recouped most losses. Someone who would be dollar cost averaging into the market and "buying and forgetting" would not even have been phased by such a market crash, and would have been buying at the lows and seeing unrealized gains only months after their purchase.

Figure 1: S&P 500 Historical Chart (2007 to February 6, 2018)

Markets will always regress back to historical means. Markets will always model company fundamentals over the long period. Don't be irked by short term volatility and downside pressure. Exploit others' emotional and irrational trading and make a quick buck!

All jokes aside, when you feel like your emotions are in the driver seat, take a deep breathe and take a step back and think of your long term investing picture. Don't let emotions become a hindrance or inconvenience to growing your investments. Just don't let it ruin your day, because tomorrow the market will go back up.