You’re sitting in a coffee shop minding your own business when out of the corner of your eye, you catch a glimpse of a young and anxious looking couple sitting on one side of a table and facing an empty chair on the other side of the table. Moments later, a gentleman walks into the coffee shop all suited up and holding a briefcase. He sits down in the empty chair and happily greets the anxious looking couple. He then takes beverage orders for all three of them, picks up their drinks at the counter, and then sits back down at the table. As he gently sets his briefcase on the table, he opens it up, and starts handing out several documents to the couple at the other end of the table. The wide eyed couple sifts through each one of the papers handed their way, and after introducing himself as the couple’s mentor and announcing this meeting as the initial mentorship meeting, the gentleman in the suit asks, “Are you looking for a once in a life time opportunity that will allow you to retire in 5 years?”

I’m sure at some point, you have heard of something called a pyramid scheme or MLM business venture. While the purpose of this article isn’t to question whether or not one can make money from these ventures (in theory you can), it does question the validity of the marketing that goes into selling the utopian dream of financial freedom and the ease to achieve it, as well as the risks that one should be aware of if partaking in such an endeavour.

A Multi Level Marketing company (MLM), or sometimes referred to as a “pyramid scheme”, are organizations that market an opportunity where you can gain financial independence at a young age, or relatively quickly. These organizations are typically built upon the premise of selling (or marketing) to you an entrepreneurial opportunity or get rich quick opportunity where you can own your own business and sell products from that very same MLM organization. The main example of this is Amway where you can open up your own online retail store and sell Amway product and receive a percentage of the revenues, and at the same time not have to worry about housing any of the inventory! Wow, sounds amazing right?

Well as with anything in life, if something sounds too good to be true, it’s because it simply is. Although most organizational structures are pyramid in nature, the main difference is that with an MLM or “pyramid scheme”, a percentage of your income goes to the person above you in the pyramid, and so on and so on. In other words, your success is largely dependent on the success of the people below you, hence the pyramid analogy. Therefore, there is a nature of compounding returns for people at the top of the pyramid who essentially see percentages of sales from any person beneath them in the pyramid. You can see how this infinite potential growth can be possible, and can lead to insurmountable amounts of income for people at the top. MLMs are simply that, a marketing structure, that aims to sell you the idea of running a successful business and become rich quickly.

The onboarding process is usually very long, and very inconspicuous in terms of revealing what exactly you will be doing to earn income. I’m not sure why this mystery typically exists throughout the mentorship process, but perhaps it is the curated curiosity that incentivizes potential new recruits to continue down the initiation process.

The onboarding process is typically done with a “mentor”, who is someone that is already running their own online retail store through the MLM organization, and is looking to recruit people who will work under them and in turn open up their own little online retail store selling, well, the very same stuff! This is the premise behind being successful in an MLM… not only growing your sales of your own online store, but recruiting people under you who then will start growing their own online store sales, and further recruiting, and so on. This is how the pyramid grows.

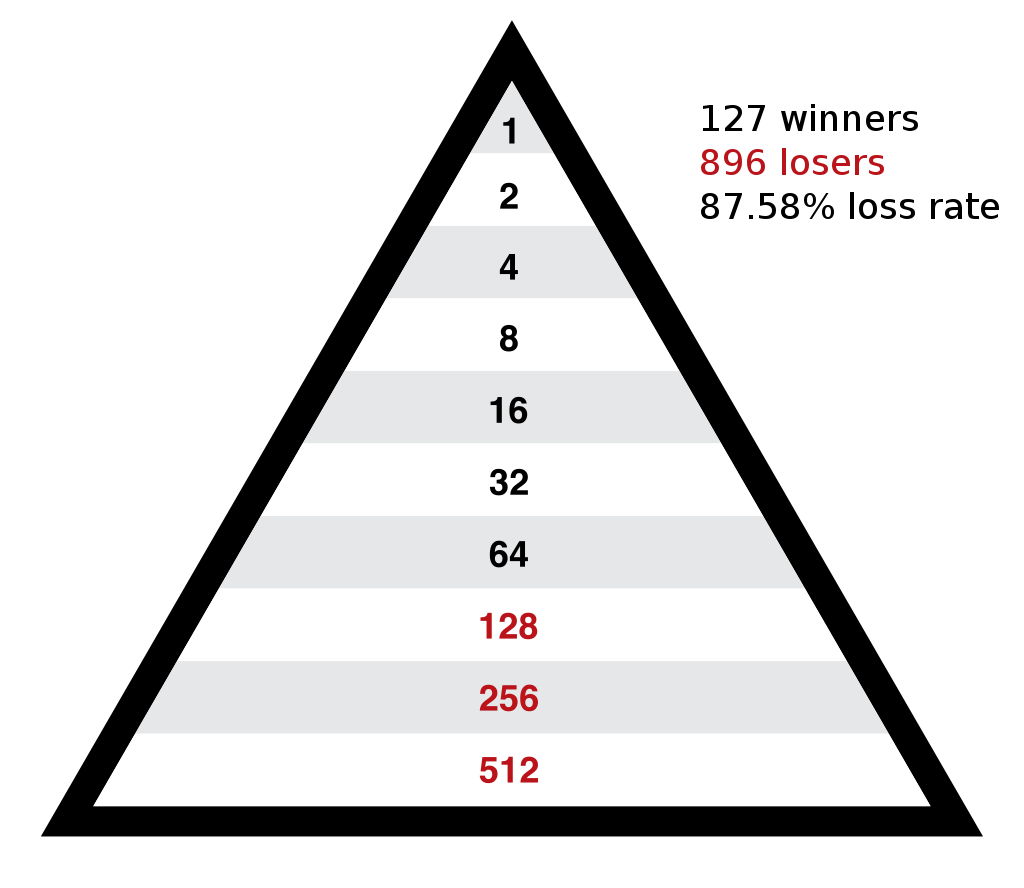

In a theory, there are only so many of the exact same stores that can exist in an economy before customer demand is simply diluted with over supply. This premise makes it harder and harder for new folks entering an MLM to be successful, because there are so many levels of people above them who are already selling the same product in the same market. Hence, the business model for a pyramid scheme becomes unstainable and the people at the bottom of the tiers become unprofitable. Even if the majority of tiers in the pyramid are successful, the bottom tiers contain so many more people due to the nature of compounding (i.e. for every one mentor, there are say 2 successful recruits) that the result is a majority of MLM participants being unportable. Figure 1 illustrates this concept:

Figure 1: Pyramid MLM Participant Failure Rate

While technically being part of an MLM isn’t illegal, and in fact can be somewhat profitable, the main deviancy involved is the promise and marketing around being successful and getting rich quick, and that anyone can do it. There is this golden oyster right in front of your eyes, and all you have to do is reach out and grab it. Well, I wish “success” was that easy, and in fact, my favorite question I like to ask MLM entrepreneurs is, “If this is so easy and profitable, then why isn’t everyone doing it?” I usually get the same lame excuse that it’s simply an awareness thing and that many people are simply not aware of such opportunity. In reality, it’s because the vast majority of people are not successful and find themselves failing at indoctrinating new recruits, or perhaps only make a little bit of side income from their MLM venture, but not enough to quit or abandon a full time job.

I have actually attended a few MLM conferences and meetings to entertain my curiosity (and clearly because I had nothing better to do that day), and it’s fascinating to see the amount of work that goes into marketing the opportunity (typically through paid actors), creating a sense of FOMO if you don’t participate, and creating a cult like culture that you can be a part of and jointly be successful together with your fellow sheep. I remember when a couple walked on stage and began telling their sob story about how they worked their 9-5 jobs and didn’t get to see each other often and had to miss birthdays and other events as a result. They claimed however that after joining Amway, they gained the financial freedom to never have to work again. Everyone in the audience stood up and started clapping. Everyone except me. I sat there and looked around the conference hall in absolute astonishment at the level of indoctrination that these people had fallen under with the promise of financial independence and freedom at an early age.

It is really a one size fits all in terms of target audience. MLMs cater to any one who wishes to become a successful entrepreneur and who wants to gain financial freedom. Marketing of these MLMs can even seem to prey on vulnerable demographics of people who are desperate to earn more money and become rich quick.

I’ve tried to lump the different types of MLMs into 3 main categories, and a description for each:

“Entrepreneur” Self Business Owner

These are the MLMs that I refer to the most in this article. These are the one’s that promise entrepreneurial success through selling product via your own online retail store, and involve continuous recruitment efforts in order to grow your own group of mentees who will end up opening their own retail stores and paying you a percentage of their revenues. Examples of this type of MLM include Amway, Mary Kay, and Herbalife, to name a few.

Insurance Products

These are MLMs that involve selling a product in the form of life insurance, and catering to the concept of investing your life insurance premiums with them to grow over time. Again, the MLM involves recruiting others to also sell these insurance products with a portion of revenue going to the mentor. However, the returns of these financial products are quite sub par compared to average market returns, and usually involve high commissions and fees paid to the fund manager over time. World Financial Group is the prime example of this type of MLM. I remember being introduced to this organization through a high school acquaintance, and when I visited their premises, I was immediately showered with compliments and praise about how nice of a car I drive and the clothes that I wear, and I had my attention steered to the plaques on the walls of all of the successful people with World Financial Group in their “Diamond Club” (i.e. highest pyramid tier). I remember arrogantly remarking that my average portfolio returns exceeded those that were stated in the marketing prospectus of a World Financial Group product, and asking what my motivation was to invest with them, and why everyone else wasn’t investing with them if the product was so elite as it was advertised. I was given the typical “lack of awareness” excuse.

FOREX Trading

This is a form of MLM that was recently introduced to me, but has actually been around for a number of years already. I’m going to purposely go into more detail on this one because it pertains to finance, and because it is the most fascinating to me.

This MLM involves selling the idea that one can be very rich by day trading, specifically, trading FOREX instruments. It sells the idea that a user can put up only a few thousand dollars, and the MLM company will provide an additional substantial amount of money (i.e. $100k) in order for the user to trade FOREX instruments with a lot of capital. In exchange for trading with funds from the MLM, any gains realised from trading will have a percentage go back to the MLM, or to whoever the mentor is that looks after the team of traders.

Now I’m no expert technical trader, but I can confidently say that no one just casually picks up forex trading one afternoon and becomes successful. Not only does this involve precise technical charting and analysis, but it also requires the user to understand the macro scale elements that cause movements in international currencies, and how those currencies relate to one another. That is not a small feat.

With that said, this MLM involves the user going through a trial period to prove their trading competence, and once approved into the program, will get access to the MLM’s exclusive trading software to trade FOREX instruments. Now I looked into this process a bit more to understand the intricacies, and here is what I know. The trial period involves the MLM giving you money to trade with, and requires you to earn a certain amount of gains within a timeframe of, say, 30 days in order to be accepted into the program. There may be multiple rounds of these trial periods, but in the end, it requires a candidate to earn X dollars within Y number of days. Now, I am skeptical as to whether these are paper trades or if the user is given real dollars during this trial period, and I am also skeptical as to whether the trading environment is set up in a way where it is almost impossible to fail, but I may be wrong here. Once accepted into the program, a user has access to the exclusive trading platform where technical charts are dummied down to a binary “Red and Green” indicator system, where the user is prompted to either BUY or SELL if all technical indicators are showing green and red respectively. Sounds pretty easy right? Ultimately over time, the MLM recommends that a user eventually becomes an educator in the space where they can recruit and teach forex trading to potential new recruits through the use of this exclusive trading platform. And so the pyramid continues with a percentage of trading gains always going to the mentor of the group. Can you believe that? Users suddenly become educators in the space of FOREX trading! My goodness, perhaps I can casually pick up and educate society on the intricacies of atmosphere breathing electric propulsion for spacecraft!

The one element of this type of MLM that I am not completely grounded on, and perhaps is the primary reason why most participants are not successful and eventually leave, is the ownership of downside risk. If the MLM company is giving you money to trade with that essentially levers the user up to 2000% margin, what happens when the trader loses money? What is the risk tolerance or loss threshold of the MLM that, once breached, will halt a user’s trading privileges, and who reimburses those losses? I got the sense that the MLM company puts you on a probation period and one more instance of continuous losses will lead to expulsion from the program. Well that still sounds like a zero risk proposition to me from the user’s perspective, especially if you are only putting up a few thousand dollars while the MLM is giving you $100,000! Perhaps the user’s losses are limited to the amount they have put up, or perhaps the user is liable for any loss amount experienced during trading. Either way, the transacting involves trading on extreme margin in relation to the user’s own invested funds, and swings in volatility of profits and losses can easily trigger a halt to one’s trading activity if the MLM company’s risk thresholds are exceeded.

There have been many FOREX trading MLMs that have existed in the past, and many have been targeted by the SEC and closed as a result due to their predatory marketing nature and potential for extreme losses. However, there are a few that are still in existence, namely IM Academy and their trading platform, Colors. I’ve included a video link here that interviews an experienced FOREX trader summarizing the pitfalls and dangers with partaking in these types of FOREX trading MLMs.

I thought it was worth writing this article to figuratively deconstruct the pyramids that exist out there that market get rich quick schemes and immediate financial freedom. This is especially important to discuss during such volatile times in equity markets and macroeconomies, and in fact, during a year where markets are down year to date (as of April 10, 2022). There seems to be no shortage of volatile ventures and financial products out there that target individuals, especially young people, as a way to get started in investing, whether this is through the use of NFTs, crypto currencies, or MLMs. There is a strong difference between “trading” and “investing”, and if someone is trading or chasing after a get rich quick mechanism in order to gain long term financial independence, then they will quickly find themselves back to the drawing board on how to realistically achieve financial independence.