For any beginner investor, starting out is always an intimidating feat. Where to put your money, how to exactly do it, who to approach for help… these are common questions that someone new to investing may have. The introduction of robo advisors such as Wealth Simple has made it a lot easier for someone to not only get started in investing, but also become interested in it. Easy to navigate tutorials to get started, non technical financial jargon, and extremely low trading fees provide a very welcoming and stress-free environment for people to get started with investing their money.

Whether your investing account will be completely hands off and managed by someone (or “something” in the case of robo advisors), or more hands on, it’s good to have some basic background information as a beginner investor around what ETFs are out there that offer the best diversification at the lowest expense, especially when starting out with a small amount of capital.

ETFs are the best way to achieve diversification when first starting out in investing without having to worry about buying individual stocks to achieve the same level of diversification.

In Lesson 17 and Lesson 26, we discuss some of the differences between ETFs and mutual funds, and in Lesson 70, we review some good ETFs to consider. I do think it’s worth reiterating some of these talking points here in this article, as well as touch upon some key things to look at when selecting ETFs.

To recap, an Exchange Traded Fund, or ETF, is a fund that owns multiple holdings (i.e. stocks or even other ETFs) within it and is managed by a fund manager. The holdings inside of the ETF will depend on what the ETF strategy goal is. For example, an ETF that is meant to track the Financial Sector will own various financial sector companies. An ETF that is meant to track large cap companies will have greater weightings in companies that have large market capitalizations, typically those traded on the Dow Jones if the ETF is US specific.

The variety of ETFs out there are immense, and it can become overwhelming when trying to decide which ETF to buy. As a result, I’ve come up with three important factors to consider when searching for an ETF. I think these factors are applicable primarily to folks residing and investing in North America, but given the size of publicly traded markets around the world, I think exposure to the US should remain relatively significant regardless of where you are investing from.

Factor 1: Exposure Weightings

Although ETFs offer instant diversification across a particular asset class or sector, it is important to consider your exposure at a high level to different international markets. Again, given the market cap and size of international markets, I believe that the following exposure is suitable for any North American Investor:

US Market ETFs: 55-65% of Total Investment Portfolio

Canada Market ETFs: 25-35% of Total Investment Portfolio

International / Emerging Market ETFs: 5-15% of Total Investment Portfolio

Folks often forget about having international exposure. While a lot of international and emerging market exposure isn’t paramount to a successful portfolio, it does offer some “resistance” or negative correlation to North American public equity markets when corrections or bear markets arise.

Arguably these exposure weightings could change with age. One may argue that folks closer to retirement should be focused on stable cash flow and be more weighted in bonds or fixed income. While that is a valid argument, if you are more than 5-10 years away from planned retirement age, I believe this argument is short sighted given the current interest rate and inflation environment we currently see ourselves in during the 21st century, especially in North America. Investing in fixed income ETFs that pay 0.25% yield while inflation fluctuates between 2-3% as asset prices continue to rise makes little sense. However, if you are within 5-10 years of retirement, it is a good idea to lessen your exposure to higher risk market ETFs (or higher risk investments in general) and focus more on low volatility and lower risk investments that provide consistent cash flow, like fixed income investments.

I would highly recommend sticking with market level ETFs for beginner investors as opposed to sector or asset class specific ETFs. Market ETFs offer instant diversification across a particular market or economy, whereas sector or asset class specific ETFs only offer diversification across its specific sector or asset class. This requires the investor to own multiple sector ETFs to ensure a proper level of diversification and exposure across a particular public market. If someone tells you their portfolio is diversified because they own a crypto ETF, you have my permission to cut them out of your circle of friends. Alternatively, you could educate them on what diversification across multiple sectors means and looks like… this is more constructive, and you get to keep a friend.

Factor 2: Management Fee and MER

This is a very important factor as this tells you how much it costs you to own this ETF. In other words, how much is the ETF manager getting paid to manage the fund and to maintain the fund weightings?

Management Expense Ratio, or MER, is the fee that is paid by the fund for operating expenses and other back end trading expenses. This fee is represented as a percentage of the total fund value. While ETF investors do not directly pay for this, the fund value return will be affected negatively over time because of these expenses that the fund pays for.

In addition to this, Management Fees are fees that are charged by the fund manager to the ETF investors for management of the fund holdings. This is no different than paying a money manager to manage your investments. Management Fees are also expressed as a percentage of the total fund value that you, the ETF investor, will pay on a monthly or annual basis.

MERs and management fee percentages are usually pretty close, and a good percentage to look for is in the 0 to 0.1% range for each.

Factor 3: ETF Selection and Currency

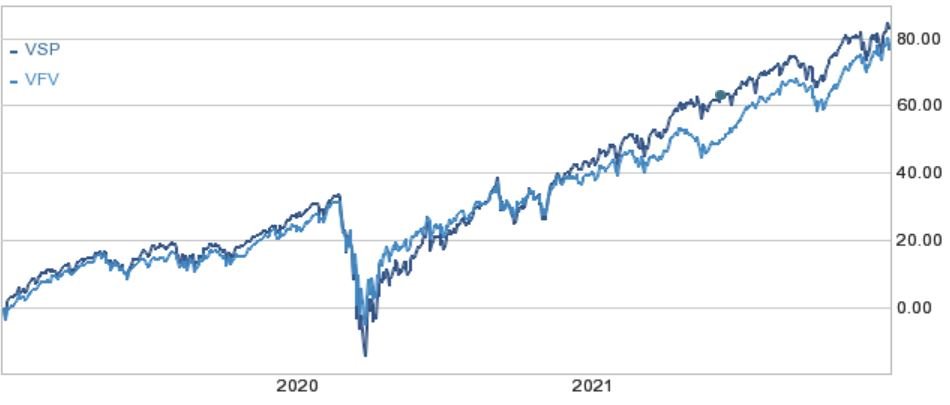

After considering factors 1 and 2, one should be able to come up with a filtered down list of ETFs for their portfolio. ETF selection will depend on not only the ETF provider of choice (which I’d argue will be dependent on management fees), but also on the currency in which you are purchasing with and exposing yourself to. For example, Canadian investors who wish to purchase ETFs that track the US markets may want to consider buying an ETF that is Canadian Dollar hedged to the US Dollar. This is especially important in an environment where the US Dollar is gaining strength compared to international currencies, specifically to the Canadian Dollar. To put it differently, if the Canadian dollar continues to trend weaker against the US Dollar, it may be worth considering a Canadian Dollar hedged US Market ETF. The performance difference between a CAD hedged and a CAD non-hedged US market ETF isn’t substantial, but over just one year, the % return can differ between 1-2%. A historical graph of an S&P500 Index ETF that is Canadian hedged (VSP in dark blue) versus a Canadian non hedged one (VFV in light blue) is shown below. The Y axis represents percent return since January 1, 2019 to December 31, 2021.

Figure 1: CAD Hedged S&P 500 Market ETF (VSP) vs. CAD Non-Hedged S&P 500 Market ETF (VFV)

With the USD nearing parity to the Euro, over time, I do think that the USD will continue to strengthen against most other international currencies, including the CAD. Rate of inflation/deflation and interest rates will also influence whether this prediction proves true. If you are a Canadian investor, I’d recommend choosing a Canadian Dollar hedged ETF if one is looking for a US Market ETF. Conversely, I’d recommend US investors to select non hedged ETFs if looking for a Canadian market ETF.

Given these three factors, I’ve provided a list of ETFs that I believe are the best for beginner investors that offer the best diversification across the US, Canada, and International & Emerging markets, while offering the lowest fees. The list under each weighting category is in order of my recommendation. These ETFs can be purchased through any Canadian or US online brokerage site or trading platform, either in registered or non registered accounts.

US ETFs |Total Portfolio Weighting: 55 – 65%

VSP - S&P 500 Index ETF (CAD-hedged)

VFV - S&P 500 Index ETF

VUS - U.S. Total Market Index ETF (CAD-hedged)

XUU - iShares Core S&P U.S. Total Market Index ETF

Canada ETFs | Total Portfolio Weighting: 25 - 35%

VCE - FTSE Canada Index ETF

VCN - FTSE Canada All Cap Index ETF

XIC - iShares Core S&P/TSX Capped Composite Index ETF

ZCN - BMO S&P TSX Capped Composite Index ETF

International/Emerging ETFs | Total Portfolio Weighting: 5 - 15%

VIU - Vanguard FTSE Developed All Cap ex North America Index ETF

VWO - Vanguard FTSE Emerging Markets Index Fund ETF Shares

VEE - FTSE Emerging Markets All Cap Index ETF

XAW - iShares Core MSCI All Country World ex Canada Index ETF